Coaching for Useful Value Propositions. Good value coaches facilitate deeper buyer understanding within their organizations. Potential customers have pre-existing opinions. They have impressions and information about the competition and about our offering that often differs from the information we provide. A good Value Proposition helps to understand the customer’s perspective and to reshape it. Good coaches help their teams to build good Value propositions by asking good, honest questions, not just about our product, but also about the competition and how we compare.

Previously, we drew parallels between coaching soccer in the three phases of the game and coaching commercial teams in the three stages of value management and value selling. Quantifying value is like playing midfield. Designing Value Propositions requires the skills of a good back or keeper. Teams selling value need to be effective strikers.

So far, in this series on coaching midfielders to quantify value, we have reviewed how to help teams frame the discussion, how to focus their mind-set on customer-centric differentiation, and how to help them quantify and dollarize the value of our positive differentiation. Based on a clear framework, differentiated features and benefits, and dollarized positive value drivers, we are ready to take a balanced, objective approach to the tradeoffs a customer might consider as they choose our offering in comparison to alternatives.

Negative Value Drivers Provide Balance. We may have a differentiated offering, but not all differentiation ends up in the plus column. Good marketers may spin our positive differentiators to maximum effect. Good product managers may dollarize them effectively. But our prices might be set at a level that invites customer resistance if they fail to account for the downside of buying our solution. Our sales teams will be exposed if we fail to consider drawbacks, address customer objections, and provide balance in a business case to buy. A robust Value Proposition provides sales teams with ways to handle objections. A balanced discussion, that acknowledges the potential downside and cost of buying our solution, builds buyer trust. Addressing the competition and potential drawbacks early improves sales effectiveness. Including quantified negative value drivers builds buyer  confidence that we have experience keeping costs manageable for other buyers. This balance is critical as customers consider whether they want to partner with us to implement our solution.

confidence that we have experience keeping costs manageable for other buyers. This balance is critical as customers consider whether they want to partner with us to implement our solution.

Quantify and Dollarize Negative Value Drivers. Identifying and quantifying negative value drivers is similar to the same process for positive value drivers. We need to identify points of negative differentiation, call out customer business parameters that our drawbacks will influence, and come up with plausible, quantitative estimates of the potential impact. With good hypotheses, we can ask good questions, tapping internal knowledge, outside experts, and friendly customers to get objective answers.

Good questions generally vary with the type of value driver:

- Some negative value drivers arise from transition costs or switching costs. Changing from the status quo usually has costs to a buyer over and above the price we charge for components of our offering.

- Other negative value drivers arise from a disadvantage our offering faces versus a direct competitor. Like positive value drivers, these negative value drivers can result in an increase in cost or risk, a potential reduction in revenue, or a negative impact on productivity. The impact is a cost, or an opportunity cost, versus direct competitors.

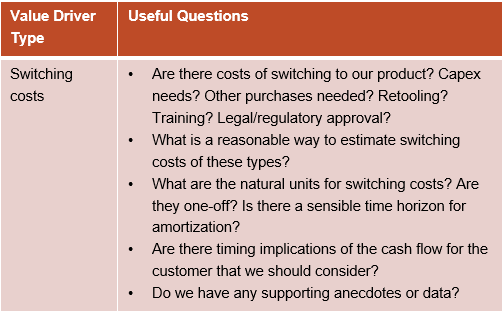

Let’s consider good coaching questions for each type of negative value driver.

Switching Costs. In considering how buying our offering might generate customer costs, we start by looking at the process the customer will undergo as they implement our solution. Are there costs of switching to our offering? Does implementing our product require capex or retooling of a production process? Is there a need for training? Is there a need for regulatory approval or new compliance processes?

Switching Costs. In considering how buying our offering might generate customer costs, we start by looking at the process the customer will undergo as they implement our solution. Are there costs of switching to our offering? Does implementing our product require capex or retooling of a production process? Is there a need for training? Is there a need for regulatory approval or new compliance processes?

As we identify switching costs, we need to keep segmentation in mind. Switching costs are relevant when we are replacing the status quo or when our customer is considering an upgrade of their current approach as the reference alternative. Switching costs are less likely to be a meaningful negative value driver when the customer is comparing our solution to a competing solution they have not implemented previously.

Based on the potential switching costs we have identified, we need a reasonable way to estimate them. Once we have identified an implementation process, this usually comes naturally. What is the capex cost? How many employees need to be trained, for how long, and at what cost? What are the direct costs and the personnel time costs of regulatory processes?

Most transition costs are one-offs. Ongoing switching costs are less likely to be meaningfully different from the reference alternative. For any one-off cost, it is important to get units right in how we calculate the negative value driver. Whether or not we have already set up a year as a unit, it is natural to think of a time horizon longer than a year if our expectation is that our customer sticks with the new solution for a multiyear period or that the equipment they buy is long-lived. Amortizing upfront, one-off, negative value drivers over the life of the equipment or the life of a contract is a natural way to acknowledge the cost of change, while highlighting that the change delivers benefits over an extended horizon. Different timing for benefits than for costs also sometimes suggests that we consider the timing of cashflows, so that we can engage in customer conversations about a payback period.

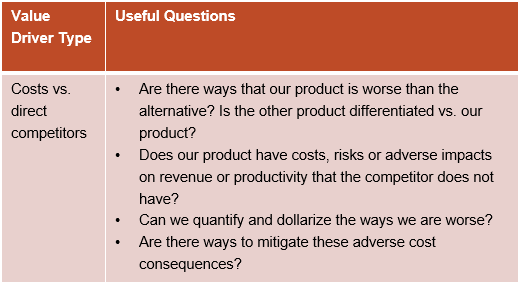

Keeping track of data and anecdotes that support our negative value drivers should be encouraged. Our objective is a transparent balancing of negatives and positives to arrive at a business case to buy our solution. The estimates we make of transitional and implementation costs need to be as plausible as our positive value driver estimates. Costs versus direct competitors. Negative value drivers also arise when our offering compares negatively with a direct competitor. The questions to ask are analogous to those we ask to quantify positive value drivers. Are there ways that our product is worse that the alternative? Is the competing offering differentiated versus our offering? These negative value drivers may relate to cost increases from our offering, costs or risks the competitor enables the buyer to avoid, adverse impacts on revenues, or reductions in productivity. Quantifying negative value drivers is much like quantifying positive value drivers in reverse. Once we identify and quantify relevant business parameters, we need to estimate our potential adverse impact on them.

Costs versus direct competitors. Negative value drivers also arise when our offering compares negatively with a direct competitor. The questions to ask are analogous to those we ask to quantify positive value drivers. Are there ways that our product is worse that the alternative? Is the competing offering differentiated versus our offering? These negative value drivers may relate to cost increases from our offering, costs or risks the competitor enables the buyer to avoid, adverse impacts on revenues, or reductions in productivity. Quantifying negative value drivers is much like quantifying positive value drivers in reverse. Once we identify and quantify relevant business parameters, we need to estimate our potential adverse impact on them.

Acknowledging negative differentiation has the benefit of helping us to identify ways to mitigate adverse consequences. For crop protection products with a disadvantage, potentially there are adjuvants that solve the problem. Their costs are measurable. For more powerful software solutions that are also more complex than the competitor’s, there may be additional configuration or implementation approaches that simplify the complexity. The time and cost they take are measurable and the anecdotes about how we have addressed these challenges for others build sales and marketing confidence.

Overcome the Noise Surrounding Negative Value Drivers. Negative value drivers sometimes develop a bad reputation in practice in some organizations. For some teams, negative value drivers are a means to lower management expectations and an excuse to cut price. We have even seen some managers who anticipate these problems and declare negative value drivers out of bounds. In the long run, an unrealistically positive view is seldom a good way to deliver consistent results. Prices that are set without a balanced regard for negatives can be an impediment to closing deals or even an excuse for undisciplined price cuts. Marketers and product managers who ignore customer challenges lose the confidence of their sales teams and rarely deliver revenue growth.

The role of a good value coach is to keep teams honest, driving objective assessment of negative value drivers while guiding teams toward constructively reducing the impact of acknowledged negatives on buying decisions. A coach’s experience of other product launches that overcame buyer hurdles builds sales confidence in responses to customer objections. A well-crafted FAQ can supplement a Value Proposition that persuasively underscores a business case to buy while acknowledging challenges.

Control the Midfield. Quantified customer value sets up effective sales plays. With a clear framework and well-articulated features and benefits, our team is equipped to identify and quantify both positive and negative value drivers. Value coaches drive teams to be objective in quantifying value, providing perspective, guidance, and experience as commercial teams understand their customers. If we understand how our product is used, we can assess and measure how we improve our customers’ business. With plausible initial estimates of the net economics of our benefits, we can come up with good questions to refine estimated value drivers, both positive and negative.

Control the Midfield. Quantified customer value sets up effective sales plays. With a clear framework and well-articulated features and benefits, our team is equipped to identify and quantify both positive and negative value drivers. Value coaches drive teams to be objective in quantifying value, providing perspective, guidance, and experience as commercial teams understand their customers. If we understand how our product is used, we can assess and measure how we improve our customers’ business. With plausible initial estimates of the net economics of our benefits, we can come up with good questions to refine estimated value drivers, both positive and negative.

The result is that good, quantified value content supports value management and value communication. Value management drives strategic decisions aligned with sustainable customer success. Value Propositions provide core sales content to support sales team collaboration with customers by focusing on the business outcomes buyers realize by purchasing our solution. Midfielders assess the competition’s strengths and weaknesses, moving the ball downfield to set up shots on goal. More shots, more goals, more victories.