Coaching. Coaches make the difference between pickup soccer and championship football. Great coaches prepare their team mentally and physically. During the match they orchestrate player adjustments by reading opportunities and diagnosing challenges. They address mental and emotional fragility. They motivate and energize their team to capitalize on momentum. Winning teams need great coaches.

The need for coaching applies across all sports and virtually all collaborative pursuits. Great coaches help business teams achieve commercial excellence. Business players don’t just walk onto the field and perform at a high professional level. They need examples, mentors, and good coaches.

Value Management and Value Selling. Value management and value selling are collaborative business pursuits where good coaching helps business teams win. Customer value is a central organizing framework for many innovative B2B enterprises aiming for commercial excellence. As a focal point for internal team discussions, customer value management improves product strategy, product management, and pricing decisions. The evidence shows that implementing a value based pricing strategy improves EBITDA by an average of 8%[1] and that the ROI of investing in value based strategies ranges from 130% to 900%.[2]

Value selling improves sales performance. Forrester Research, surveying buyers, found that, “the first vendor to succeed in communicating a vision to executives wins the business 74% of the time.” The key to that win rate, according to Forrester, is that the winning vendor works with the buyer to turn the vision into “a clear path to value.” CRM data from organizations adopting value selling show that opportunities where a Value Proposition is used (1) have 5-15% higher win rates and (2) 5-25% higher price outcomes.

Coaches in Value-Centric Organizations. Obtaining these results is not difficult but it requires discipline and high quality programs. Companies often formally designate value champions and value coaches in their organizations to support others in value management and value selling. Coaches understand the game. Most coaches are experienced players. As we work with great coaches and coach great players, we at LeveragePoint are fortunate enough to witness and appreciate approaches to value management and value selling that are effective. We hope this blog series captures some of their best practices.

Coaches help commercial teams deploy customer value in three phases that correspond to the three primary roles in soccer.

Teams quantify customer value in order to set product strategy, understand segments, structure offerings, and set value based prices. In order to understand quantified value, product managers and marketers need to play like midfielders. They mix it up with buyers, understanding and probing for customers’ pain points, objectives, and business parameters. Marketers understand how different buyers respond to the benefits they offer and measure that response. Product managers use quantified value to understand their positioning, design their offerings, and price their solution.

Teams quantify customer value in order to set product strategy, understand segments, structure offerings, and set value based prices. In order to understand quantified value, product managers and marketers need to play like midfielders. They mix it up with buyers, understanding and probing for customers’ pain points, objectives, and business parameters. Marketers understand how different buyers respond to the benefits they offer and measure that response. Product managers use quantified value to understand their positioning, design their offerings, and price their solution. Commercial teams design sales-ready Value Propositions for use in customer conversations by their sales teams. In designing effective Value Propositions, marketers and product managers need to play like backs and keepers. They look downfield trying to assess how their teammates will receive and distribute the ball to engage the buyer team and move transactions toward the goal. As they seek to serve up content effectively, they observe what is working so that their ball placement for effective follow-on play improves throughout the match.

Commercial teams design sales-ready Value Propositions for use in customer conversations by their sales teams. In designing effective Value Propositions, marketers and product managers need to play like backs and keepers. They look downfield trying to assess how their teammates will receive and distribute the ball to engage the buyer team and move transactions toward the goal. As they seek to serve up content effectively, they observe what is working so that their ball placement for effective follow-on play improves throughout the match. Sales teams sell value as part of their early engagement with buyers, collaborating with buyers evaluating their solution, in order to get a shared business case that speeds negotiation and closing. In selling value, sales teams need to move the ball forward, creating opportunities as they change their mind-set to play like strikers. Initially the sales rep or account manager engages with defenders considering their advances. Strikers pass the ball to members of their presales teams who establish position to create opportunities near the goal. They distribute the ball in front of the goal to get shots at a buyer team. Sometimes they are wide of the mark and need to regroup. Sometimes the questions they get stop them cold, driving the ball backwards where they start again. Sometimes they scooooore!

Sales teams sell value as part of their early engagement with buyers, collaborating with buyers evaluating their solution, in order to get a shared business case that speeds negotiation and closing. In selling value, sales teams need to move the ball forward, creating opportunities as they change their mind-set to play like strikers. Initially the sales rep or account manager engages with defenders considering their advances. Strikers pass the ball to members of their presales teams who establish position to create opportunities near the goal. They distribute the ball in front of the goal to get shots at a buyer team. Sometimes they are wide of the mark and need to regroup. Sometimes the questions they get stop them cold, driving the ball backwards where they start again. Sometimes they scooooore!

Unlike soccer, value management and value selling are not zero sum games. When the seller scores a point, the buyer realizes value. That said, the mentality and activities of a team, seeking to win with its buyers, need to be continually re-oriented toward customer value as the central basis to understand and engage with customers.

In the first part of this blog series, we concentrate on a coach’s playbook for midfielders, focusing on best practices to support our product and marketing teams in quantifying value. We will return to the challenges of coaching backs and strikers later.

Value Coaching: Ask Good Questions. The best coaches motivate, train, and teach. Their teaching style is almost never lecture hall presentation of theory. Good value teaching is usually contextual, helping a team specifically work on a project. Good value teaching is less about conveying information than it is about asking the right questions so that team members dig deeper and experience their own realizations about the value they deliver.

Not all team members appreciate a bombardment of questions. To motivate teams to answer questions well and to challenge teams to ask their own questions, it is always a good idea to keep objectives and benefits front and center.

The Midfielders Playbook

1.1. Prepare to Quantify Value – Frame the Discussion. Great midfielders look for space on the field and go to where it is. Great value coaches help their teams see the market landscape strategically so that they can find the most productive space on the pitch. Before charging in to quantify value, it is critical that teams frame their value discussion so that they understand where they are on the field.

Quantified and dollarized value are specific and relative. They only make sense when the assumptions and frame of reference are clear. Analytically, this requires a series of questions:

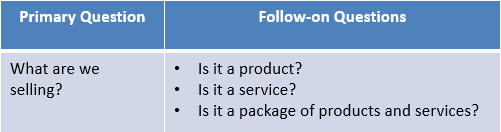

What are we selling? We need to think clearly about our offering or offerings. Are we selling a product? Are we selling a set of services? Are we selling a package of products and services? Do we always sell our product packaged together with services or do we offer more than one customer choice of packages they might buy?

What are we selling? We need to think clearly about our offering or offerings. Are we selling a product? Are we selling a set of services? Are we selling a package of products and services? Do we always sell our product packaged together with services or do we offer more than one customer choice of packages they might buy?

Thinking clearly about our offering and its components helps identify elements of the offering that are differentiated. It also helps identify what we are pricing. Different elements of our offering may have distinguishable costs which we should understand. Being clear about components of our offering will help later as we think through multiple offerings and possible packages. Although our initial value quantification may be for just one offering, it is a good idea to keep track of its elements so that we can return to our offering strategy and consider value differences and price differences that vary with the offering a customer chooses.

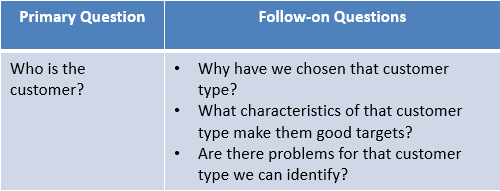

Who is the customer? We need to have a clear customer or customer segment in mind. Who are we selling to? What is the customer’s profile? Why have we chosen that customer type? What characteristics of that customer type make them good targets? Are there problems for that customer type we can identify? Is there a value chain of downstream customers we may not deal with directly who realize our offering’s value in ways distinct from the value realized by our direct customers?

Who is the customer? We need to have a clear customer or customer segment in mind. Who are we selling to? What is the customer’s profile? Why have we chosen that customer type? What characteristics of that customer type make them good targets? Are there problems for that customer type we can identify? Is there a value chain of downstream customers we may not deal with directly who realize our offering’s value in ways distinct from the value realized by our direct customers?

Having a clear picture of our customer is required to identify the business benefits we offer. A specific customer type or segment helps focus our thoughts. In choosing a customer type, we should choose a target who will realize meaningful value from our offering. Keeping track of the reasons for our choice and the customer types we don’t choose initially will help later as we consider other customer types and look at value-based segmentation. Asking good questions early about our customer also helps identify elements of the value chain that matter. If our customer’s customer realizes value from our differentiated offering, we need to understand that and communicate it clearly to our customer.

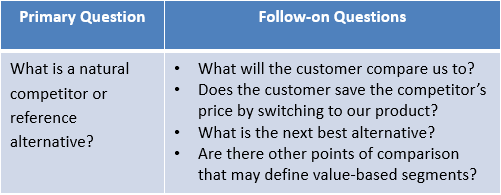

What is a natural competitor or reference alternative? What will the customer compare our offering to? The status quo? A competing purchase? Does the customer save the competitor’s price by switching to our product? What is the next best alternative? Are there other points of comparison that may define value-based segments?

What is a natural competitor or reference alternative? What will the customer compare our offering to? The status quo? A competing purchase? Does the customer save the competitor’s price by switching to our product? What is the next best alternative? Are there other points of comparison that may define value-based segments?

Value can only be assessed relative to an alternative or a point of comparison. Quantifying specific value requires having a competitive reference point. In picking a competitor we should choose a clear reference alternative that is relevant for the customer type we have chosen. Identifying and tracking other reference alternatives, including the status quo and other direct competitors, will help with different customer types. It will also help as a single customer considers more than one alternative. That said, identifying the next best alternative initially is the most useful approach for pricing.

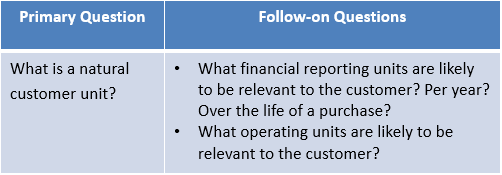

What is a natural customer unit? Customers want to hear answers quantified in terms they can understand. Price per ____? Value per ____? Units make a difference in measuring customer value, in setting price, and communicating value. There are two kinds of unit: product-based units and customer-based units. We need to start with customer-based units. How do customers report financial results? Per year? How does your offering impact them? Over the life of a contract or a piece of equipment? What operating units matter to the customer? Per unit of their output?

What is a natural customer unit? Customers want to hear answers quantified in terms they can understand. Price per ____? Value per ____? Units make a difference in measuring customer value, in setting price, and communicating value. There are two kinds of unit: product-based units and customer-based units. We need to start with customer-based units. How do customers report financial results? Per year? How does your offering impact them? Over the life of a contract or a piece of equipment? What operating units matter to the customer? Per unit of their output?

Framing our discussions based on customer units makes a difference. Our commercial team speaks the customer’s language. We can focus on our product’s direct impact on our customer’s business, making it easier to ask questions and avoid math mistakes. Using customer units helps capitalize on innovation that enables our customer to buy less of our offering than they buy from competitors. It is always best to start with, communicate, and check both value and price in customer-centric units.

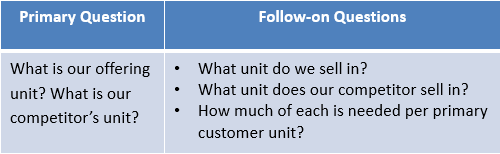

What is our offering unit? What is our competitor’s unit? What unit do we sell in? What is our price metric? What unit or price metric is most relevant to our reference competitor? Do our units and our competitor’s units translate differently into customer units?

What is our offering unit? What is our competitor’s unit? What unit do we sell in? What is our price metric? What unit or price metric is most relevant to our reference competitor? Do our units and our competitor’s units translate differently into customer units?

We know our internal conversations and forecasts will be based on the units we sell in. We should identify upfront how our units and our competitors’ units convert into customer units, so that we can identify communication challenges and reduce the impact of sticker shock when a customer needs to buy less of our product than they buy from the competitor.

Get Past the Objections to Quantifying Value. Commercial teams often get hung up when they ask their first specific quantitative questions. The answer to an early question all too often is, “it varies” or “it depends.” Specific quantitative answers regarding how much better we are, and what that is worth to the customer, often change with customer, offering, and the reference alternative in the customer’s buying process.

Get Past the Objections to Quantifying Value. Commercial teams often get hung up when they ask their first specific quantitative questions. The answer to an early question all too often is, “it varies” or “it depends.” Specific quantitative answers regarding how much better we are, and what that is worth to the customer, often change with customer, offering, and the reference alternative in the customer’s buying process.

Framing the discussion with specific choices helps us to start somewhere. A concrete set of answers, specific to customer type, offering, and competitor, makes the substance of our Value Proposition real and representative. That helps the team get to the quantitative essentials and to visualize how a customer conversation might work best. We can then refine and generalize a specific Value Proposition across offerings, competitors, and segments to maximize the quality and relevance of the underlying value content.

There is important and useful information in early answers of “it varies” and “it depends.” We should keep track of the variations in customer type, offering, and competitor and how these variations are likely to change the elements of our Value Proposition, even as we focus on a specific case. Variations usually relate to a few data assumptions and the inclusion or exclusion of value drivers and price components. Later this information helps organize a single Value Proposition for simple use in a variety of customer situations our commercial team can expect to face.

Great Midfield Play. As product managers prepare to understand their customers better by quantifying value, they benefit by clarifying their framework for value quantification upfront. Value coaches, often less familiar with the commercial landscape faced by the teams they coach, usually find that asking these framing questions is a good way to catch up quickly with the commercial challenges they are trying to address. The framing questions also help teams get in the mode of thinking like their customers as they consider how to engage them to understand value. The framework helps them think more clearly, ask questions more efficiently, and avoid confusion.

Great Midfield Play. As product managers prepare to understand their customers better by quantifying value, they benefit by clarifying their framework for value quantification upfront. Value coaches, often less familiar with the commercial landscape faced by the teams they coach, usually find that asking these framing questions is a good way to catch up quickly with the commercial challenges they are trying to address. The framing questions also help teams get in the mode of thinking like their customers as they consider how to engage them to understand value. The framework helps them think more clearly, ask questions more efficiently, and avoid confusion.

The end result is value content that supports value management and value communication. Value management drives strategic decisions aligned with sustainable customer success. Value Propositions provide core sales content to support sales team collaboration with customers by focusing on the business outcomes buyers will realize by purchasing our solution. Midfielders see the field, setting up plays, and passing better. More wins and championships are the consequence.

To get the coach’s playcard click here.

To learn more about how to quantify value see:

Can Your Sales Team Sell Your Solution’s Value?

To learn more about how sales teams use Value Propositions see:

Value Propositions for B2B Sales Effectiveness

[1] See John Hogan, “Building a World-Class Pricing Capability: Where Does Your Company Stack Up?” Monitor Group Perspectives, 2008.

[2] See Stephan Liozu and Andreas Hinterhuber, eds., The RoI of Pricing, Measuring the Impact and Making the Business Case (Routledge, 2014), especially the chapter by Stephan Liozu, “RoI and the impact of pricing: the state of the profession.”