Fusion is more powerful than fission. H-bombs are more destructive than A-bombs. Yet fusion-based power is still many years and hundreds of billions of dollars away from commercial reality, even though fission-based electricity peaked a decade ago. Neither smashing atoms together nor blowing them apart has become the predominant technology in generating power.

Fusion is more powerful than fission. H-bombs are more destructive than A-bombs. Yet fusion-based power is still many years and hundreds of billions of dollars away from commercial reality, even though fission-based electricity peaked a decade ago. Neither smashing atoms together nor blowing them apart has become the predominant technology in generating power.

Similarly, there is no dominant B2B best practice in the choice between packaged solutions and a la carte offerings. There are good reasons to offer packaged B2B solutions, but direct observation indicates that they do not overwhelm the reasons to sell products and services a la carte. Neither smashing products and services together nor blowing them apart has become the predominant B2B offering strategy.

Similarly, there is no dominant B2B best practice in the choice between packaged solutions and a la carte offerings. There are good reasons to offer packaged B2B solutions, but direct observation indicates that they do not overwhelm the reasons to sell products and services a la carte. Neither smashing products and services together nor blowing them apart has become the predominant B2B offering strategy.

So far in this blog series, we have highlighted the factors driving packaged solutions as a preferred offering strategy, and we have explored six good reasons to package in some depth: to simplify buyer choice, to increase demand, to segment pricing, to realize buyer synergies, to reset price metrics, and to generate cost synergies. We have emphasized that quantifying value and communicating value are essential in structuring differentiated B2B product and service packages.

So far in this blog series, we have highlighted the factors driving packaged solutions as a preferred offering strategy, and we have explored six good reasons to package in some depth: to simplify buyer choice, to increase demand, to segment pricing, to realize buyer synergies, to reset price metrics, and to generate cost synergies. We have emphasized that quantifying value and communicating value are essential in structuring differentiated B2B product and service packages.

In this concluding installment of the series, we step back to compare and contrast the different pricing and offering implications of the six good reasons to package. Then we consider the reasons NOT to bundle, before we outline a value based framework as the basis to make good offering design decisions.

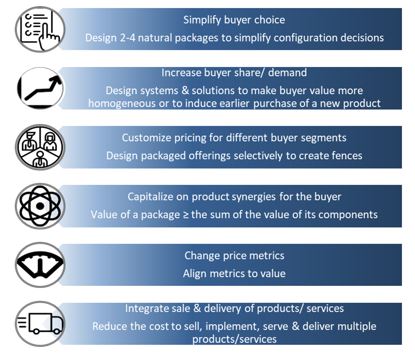

Six Reasons to Package Solutions. Briefly summarized, the six good reasons to offer packaged systems and solutions are the following:

Simplify buyer choice. Packaged offerings make it easier for buyers to choose an effective combination of products and services.

Simplify buyer choice. Packaged offerings make it easier for buyers to choose an effective combination of products and services.- Increase buyer demand. Packaged solutions can provide additional alternatives for customer choice, potentially at a discount, becoming a way to increase demand.

- Customize pricing for specific buyer segments. Providing combination packages that apply to specific segments supports different pricing across identifiable, value-based segments.

- Capitalize on product/service buyer synergies. Packages of differentiated products and services frequently deliver more value to customers when purchased in combination than the sum of their a la carte value when purchased individually.

- Improve price metrics. A packaged system or solution can provide a natural way to change the price metric previously used for products or services to a metric more aligned with customer value.

- Integrate sale & delivery of products and services. Combining products and services into a package frequently provides cost synergies in how they are sold and delivered, reducing the cost to acquire, retain, and serve customers.

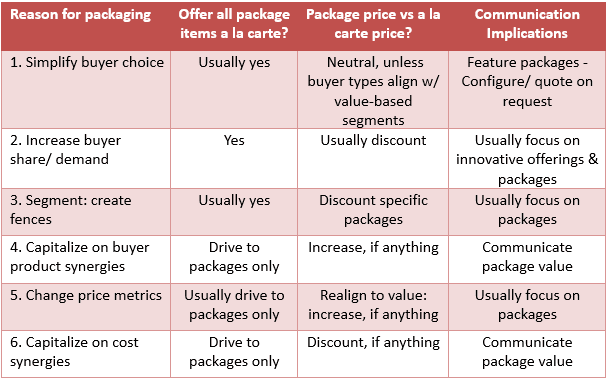

Strategic Implications of the Six Reasons. These six reasons to package are not mutually exclusive. In practice, two or three of them are more important than others in many situations. But it is notable that the six reasons have different implications. In previous installments of the series, we have highlighted these implications with case studies, but it is useful to draw a comparison together in a summary table:

The comparative table suggests several conclusions about “mixed bundling,” the economists’ term for offering a mixture of packaged solutions and a la carte products or services, versus “pure bundling,” where offering packaged solutions is the primary approach:

- Mixed bundling is not necessarily the best strategy. Strong buyer synergies, an initiative to change price metrics, and strong cost synergies (reasons 4-6 for packaging) all drive a business’ offering strategy toward packaged solutions (pure bundling).

- “Packages” or “bundles” do not necessarily imply discounted prices. When packaged solutions offer higher value due to buyer synergies (reason 4), premium package pricing makes sense. When changes in price metrics for packages help to align prices more closely with value (reason 5), good package pricing may result in a mix of premium pricing and discounted pricing.

- When packaged offerings make sense, focus communication on the packaged offerings. Even if mixed bundling is the prescribed offering strategy, the only reason not to focus communication resources on packaged solutions is when a la carte offerings are the primary offering to specific, important segments. Simplifying buyer choice (reason 1) often drives the primary marketing focus toward packages. Generally, it makes sense to focus communication on packaged solutions.

Fission: Why Unbundle? As Jim Barksdale suggests, bundles are not always the most profitable strategy. Commercial operations focused on packaged solutions often evolve into a state where their offerings are suboptimal relative to their changing customer base. When bundles are accidental or historical (“that’s what we’ve always done,” “that’s what our customers expect”), it is usually time to consider a la carte offerings as part of the offering strategy. There are three reasons that drive business offering strategies away from packaged solutions:[1]

Fission: Why Unbundle? As Jim Barksdale suggests, bundles are not always the most profitable strategy. Commercial operations focused on packaged solutions often evolve into a state where their offerings are suboptimal relative to their changing customer base. When bundles are accidental or historical (“that’s what we’ve always done,” “that’s what our customers expect”), it is usually time to consider a la carte offerings as part of the offering strategy. There are three reasons that drive business offering strategies away from packaged solutions:[1]

- Different costs to serve across components of a package. Different costs to serve frequently arise with respect to services included in a solution. Often these services have been gradually incorporated into an expanding offering for free, as a commercial team responds to competitors and seeks to drive growth. B2B examples include: expedited delivery, better logistic services, advantageous financing, training services and on-call coaching. Often these services are viewed as necessary to drive long-term customer success with the product, but the result is that cost variations make some customers more profitable than others. Product bundles may present similar issues when they fail to upcharge for costly add-ons, for example: data storage, customized product design, and long term warranty coverage. Moving toward a la carte pricing frequently helps to align price with cost.

- Different customer value of different package elements. Customers may value components of a package, both products and services, differently. Worse than that, they may not recognize the value of individual elements of a package unless there is a price attached to that element. A la carte prices are one way to address this problem. An alternative approach is to restructure the design of solutions, so that some offerings exclude undervalued package components. In effect, unbundling becomes a way to improve pricing segmentation.

- Underfocused commercial teams. When product managers are stretched to cover complicated offering packages, they often lose focus on separable elements of the package. If those elements are important potential differentiators, new entrants and innovators can develop specialized products or services that, while only better in a few dimensions, end up taking market share. Separate management of discrete components of a package can help maintain a competitive edge for major portions of the solution. Specialized customer-facing members of the team are motivated to obtain better information about their portion of the larger solution. A la carte product and service management is often a means to improve incentives and focus.

In sum, there are good strategic reasons to reconsider packaged solutions and drive toward a more unbundled approach.

A Value Framework for Offer Design Decisions. When more than one of the six reasons to package apply to a situation simultaneously, their implications sometimes clash. When some of the factors that drive unbundling are also present, the best approach to offer design usually gets murkier. The best way to resolve the conflicting implications of multiple factors is to consider the quantitative tradeoffs based on value and cost.

Here are eight steps toward a good value framework when considering a group of products and services in designing offers:

- Identify the list of products and services that might be part of a package. It is easy to change the list later, but it is natural to start with the main alternatives for potential combination into a packaged solution. Identify their primary competitors and how they are sold, including their price metrics, if they are already on the market.

- Quantify the value of individual products and/or services. For each important product and service, develop a good understanding of its differentiation and what that differentiation is worth to customers. This is a critical foundation. If you have identified segments in advance, focus on one important segment for value quantification.

- Identify value based segments. Usually this goes hand in hand with quantifying the value. Whenever “it depends” is the answer to “what is the value?”, there is likely to be an identifiable segment. Commercial teams are generally best served if they identify a comprehensive list of potential value drivers as they go, even as they focus on one segment. They can come back later to ask whether some of the value drivers are mutually exclusive and which of the value driver calculations depend on identifiable differences in customer type.

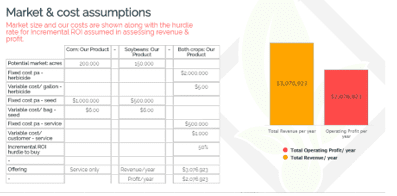

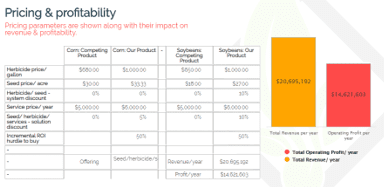

- Extend your value model to relevant segments: calculate value (and price) based on answers to questions. Some segments may be obvious: “corn vs. soybeans,” where yields and prices are different for the two crops. Others may require deeper customer understanding: “how do you handle insufficient capacity?”, “what is your standard dosing practice?”, “how do you currently handle your compliance operations?” Answers to these questions usually mean that: (a) some assumptions are different, (b) some value drivers do not apply (c) the reference competitor changes, and/or (d) that your offering changes.

- Embed cost, margin, and volume calculations.

For cost, simple calculations based on fixed vs. variable cost are usually good enough. Margins follow naturally from a set of price assumptions. Estimating volumes sold can be simple or sophisticated, but volumes should be associated with relative value. For products or services with a price premium, we like to look at the incremental ROI: the value to the customer net of our price divided by our price premium compared to the reference value. If the return from making an incremental investment is substantial (100-200%) this suggests significant volumes from new customers, even if they face uncertainty and imperfect information about a solution’s advantages. An alternative approach for discounted prices is to consider the net value to the customer divided by the total price paid. When net value reaches 10-20% of price, it is reasonable to expect significant volume increases. Volume estimates can be based on thresholds or based on a functional relationship to key value metrics.

For cost, simple calculations based on fixed vs. variable cost are usually good enough. Margins follow naturally from a set of price assumptions. Estimating volumes sold can be simple or sophisticated, but volumes should be associated with relative value. For products or services with a price premium, we like to look at the incremental ROI: the value to the customer net of our price divided by our price premium compared to the reference value. If the return from making an incremental investment is substantial (100-200%) this suggests significant volumes from new customers, even if they face uncertainty and imperfect information about a solution’s advantages. An alternative approach for discounted prices is to consider the net value to the customer divided by the total price paid. When net value reaches 10-20% of price, it is reasonable to expect significant volume increases. Volume estimates can be based on thresholds or based on a functional relationship to key value metrics. - Identify and quantify buyer value synergies, seller cost synergies, and alternative price metrics. As highlighted previously, synergies and metrics are important in designing and pricing suitable packages. They are also important in developing the right content for communication. Quantify the synergies and base the value and communication for packages on combined, synergistic effects.

- Set up alternative offer designs for comparison. These include choices for a la carte pricing and package pricing, as well as an ability to look at these by segment. Initially, it often makes sense to consider different price discounts or premiums for packages, in comparison to a la carte choices. Package discounts and premiums can vary between segments vary when offer design makes fences possible. A common sense comparison of package and a la carte prices to consider sales cannibalization makes sense whenever mixed bundling is the chosen strategy.

- Compare profitability.

The best offer designs emerge from an understanding of value, markets, and costs to maximize profitability. Based on a good value management process, the tools are available to make a direct comparison that guides offering, pricing, and communication. The process of understanding value invariably generates insights into customers, hypotheses to test, and creative approaches to offering design. Often it makes sense to pilot an offering and pricing strategy narrowly to test and improve it, where the value framework is the reference point for refinement and evaluation. Pilot information that is consolidated into the value framework can then guide broader offering strategies to enhance profit.

The best offer designs emerge from an understanding of value, markets, and costs to maximize profitability. Based on a good value management process, the tools are available to make a direct comparison that guides offering, pricing, and communication. The process of understanding value invariably generates insights into customers, hypotheses to test, and creative approaches to offering design. Often it makes sense to pilot an offering and pricing strategy narrowly to test and improve it, where the value framework is the reference point for refinement and evaluation. Pilot information that is consolidated into the value framework can then guide broader offering strategies to enhance profit.

Summary: Value Based Decision-Making, Pricing and Selling. When designing differentiated product and service packages, understanding, quantifying and communicating value are critical. The six reasons for packaging explored in this series have different implications. In practice, good offer design involves identifying quantitatively which one or several of these six reasons are most important in a given situation. This helps to set clear objectives in structuring and pricing packages and in managing the remainder of the product and service portfolio.

Understanding value is central to good innovation and product launch disciplines. Qualitative value helps to position, structure and price offers more effectively. Quantified value helps to design better offers by identifying segments, understanding value by segment, and identifying value and cost synergies. Effective value communication is mission critical in achieving the full benefit from selling valuable packaged solutions.

Understanding value is central to good innovation and product launch disciplines. Qualitative value helps to position, structure and price offers more effectively. Quantified value helps to design better offers by identifying segments, understanding value by segment, and identifying value and cost synergies. Effective value communication is mission critical in achieving the full benefit from selling valuable packaged solutions.

Great B2B organizations are customer-centric. Innovative businesses perform better if they base their offering and pricing decisions on customer value. Value selling conversations with buyers bring the customer’s business problems into focus, highlighting product, service, and solution differentiation based on customer outcomes delivered. In sales, value conversations generate collaborative customer relationships and accelerate sales cycles, driving higher revenues, greater profitability, and faster uptake of new systems and solutions at launch.

To learn more about how to quantify value see:

Can Your Sales Team Sell Your Solution’s Value?

To learn more about how sales teams use Value Propositions see:

Value Propositions for B2B Sales Effectiveness

[1]See Thomas T. Nagle and Georg Müller, The Strategy and Tactics of Pricing, A Guide to Growing More Profitably (Routledge, 6th edition, 2018), pp. 84-85 for a discussion of unbundling strategically with a focus on the first two reasons above.