Follow Up from June 2013 Webinar with Kalypso

To view our webinars and other resources please visit our Resource Center.

Q: How do you take into account the competitive landscape and what other companies are offering into the DTV (Design to Value) analysis?

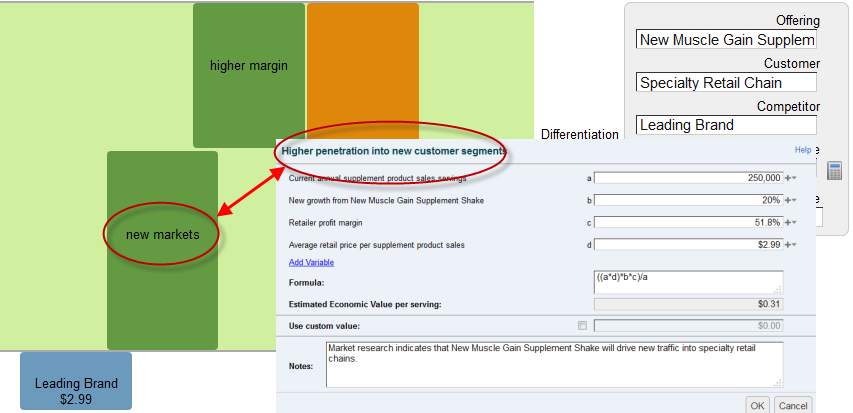

Reed: When you look at when the market research team goes out and learns about the market, they’re not only learning what consumers want, but also what consumers want relative to what they already have in the market. In other words, what product attributes are needed to win? What product attributes will really differentiate our offering in the market? Drilling into a value driver such as new market penetration [see the figure below], having a tool like LeveragePoint shows why it’s important to do assumption-based decision making, document those assumptions, and refine them over time. Even though you’re doing this from the perspective of the retailer, if you have a value driver that is going to drive higher margins or new markets, you need some assumptions of why that is. You may use the notes section to say, “based on this attribute, we think customers will be willing to pay a price premium of x”, which is an assumption you can refine over time. Having a platform gives you a structured way to capture those assumptions and, as you learn, refine them.

Bill: I think particularly in fast-moving industries like consumer goods or consumer electronics, monitoring the competitive landscape is an important part of marketing’s reponsibility during development and as these decisions are being made. What you can do is, look at not only how competitors’ products are performing, but also look at what features are really being valued and utilized. Often, you can create superior products by “de-featuring” them and making simpler solutions that only contain those features that customers are really willing to pay for.

Q: Market research is very expensive. Are you proposing that companies spend a lot money on it before they understand the product definition?

Reed: We are proposing that, but that often happens anyway. Often market research comes before prototyping, and all we’re suggesting is shifting the sequencing of that to allow it to happen in parallel with development. Now of course, there are many different types of market research and a full-scale, quantitative test market type of study can be very costly, but that will usually happen later in the process. The type of marketing that you’re doing in these early stages is often qualitative. It could be as simple as focus groups, just trying to understand what features and benefits are most important to customers, even if you can’t yet quantify them.

Ed: From my own experiences working with customers at LeveragePoint, there’s a lot of knowledge embedded within the existing organization. We find that by having people on a platform to think about features-to-benefits mapping allows people to share what they know. In the early stages, you just want to make sure that you document some of the assumptions you have going in. Those can be validated in many different ways that don’t necessarily require hiring a market research firm. You can validate some of these value hypotheses by just going through your customer-facing organization, whether that is sales, services, etc. You can do point-by-point research in the natural flow of communicating with customers, and more of that is available today. This allows you to validate things on the fly very quickly.

Q: How does the Design to Value process help companies achieve bigger breakthrough innovations? How do you avoid “going too far?”

Bill: That’s related to the concept of “de-featuring” products and being successful with a stripped-down solution. If you take the example of digital cameras, it is amazing the power that a digital SLR (single-lens reflex) in the market has today, the things that they are capable of doing, and the professional quality that they provide. And yet, what do people use to take 90% of photographs? They’re using their phone. So, unless you can create products that are both highly capable and have that same ease-of-use and simplicity, you’re going to struggle to reach the volumes that may have been modeled when the product concept was put together.

So it’s really important when you’re doing design to value work, that you hone in on those specifics that create vectors of differentiation, and that customers are willing to pay for. That allows you to be much smarter about concept selection, and working on products that are going to create real advantages in the marketplace.