Last week, in Part 1 of this blog series, I discussed what a value-based product strategy is and how it helps make better decisions on differentiation. Now it’s time to address the 6 major ways where I’ve seen Product Managers go wrong on value. These are the misconceptions or behaviors that get in the way of creating a viable value product strategy. So by recognizing these common traps, you can begin to remove these barriers:

Avoiding the Issue. Product managers are very busy people. Usually when a new strategic initiative is thrust upon them, such as value, the defensive instinct is to run to the beach and wait it out. Particularly with value, there is a fear factor.The most frequent objection is, “we don’t have time.” To which I say, “No time to think about customers? No time to think about your differentiation!” This is what you already do. Why not frame this in a value approach? It will help you make better decisions. Otherwise, you are just moving down the road without a clear map. You may eventually still get there, but you’ve lost time and money.Each day you delay could be costing your company millions of dollars in lost opportunity. The only way to overcome this obstacle is by personal leadership. If you can’t do it for your company, do it for your Strategic Business Unit. If you can’t do it for your SBU, do it for your product line. If you can’t do it there, then try it for one project. But just do it – and start ASAP!

Avoiding the Issue. Product managers are very busy people. Usually when a new strategic initiative is thrust upon them, such as value, the defensive instinct is to run to the beach and wait it out. Particularly with value, there is a fear factor.The most frequent objection is, “we don’t have time.” To which I say, “No time to think about customers? No time to think about your differentiation!” This is what you already do. Why not frame this in a value approach? It will help you make better decisions. Otherwise, you are just moving down the road without a clear map. You may eventually still get there, but you’ve lost time and money.Each day you delay could be costing your company millions of dollars in lost opportunity. The only way to overcome this obstacle is by personal leadership. If you can’t do it for your company, do it for your Strategic Business Unit. If you can’t do it for your SBU, do it for your product line. If you can’t do it there, then try it for one project. But just do it – and start ASAP! Lacking critical knowledge about the customer. I confess that I get this look sometimes. We product managers know a lot about our products, the technical requirements of our B2B customers, and probably something about their procurement practices, and so on.But I would bet you that your biggest knowledge gap is about your customer’s operations. For example, do you know what the impact of your product is on your customer’s cost of manufacturing? Or on downstream customer service costs? Or inventory? Or regulatory compliance or risk? Etc.? (by the way – this is when I get that look) Or do you know any details about your customer’s go-to-market strategy for their products. For example, does your product help your customer expand into new markets? Or increase their differentiation to their customers? Or, for that matter, do you really know what your customer’s best competitive alternative is – in other words, what would they do if they didn’t buy your product? Do you know if it’s another company or perhaps an in-house solution or just buying nothing at all?Having good answers to these questions are major pieces to your value strategy. If you don’t, then you need to start working on these.

Lacking critical knowledge about the customer. I confess that I get this look sometimes. We product managers know a lot about our products, the technical requirements of our B2B customers, and probably something about their procurement practices, and so on.But I would bet you that your biggest knowledge gap is about your customer’s operations. For example, do you know what the impact of your product is on your customer’s cost of manufacturing? Or on downstream customer service costs? Or inventory? Or regulatory compliance or risk? Etc.? (by the way – this is when I get that look) Or do you know any details about your customer’s go-to-market strategy for their products. For example, does your product help your customer expand into new markets? Or increase their differentiation to their customers? Or, for that matter, do you really know what your customer’s best competitive alternative is – in other words, what would they do if they didn’t buy your product? Do you know if it’s another company or perhaps an in-house solution or just buying nothing at all?Having good answers to these questions are major pieces to your value strategy. If you don’t, then you need to start working on these. Death by Data. Sometimes when companies get over their inhibitions about value estimation, things can get out of hand and you get death by data. Usually the weapon of choice is a spreadsheet – often created by some long ago anonymous expert. They are loaded with tabs, pivot tables, and complex what-if scenarios and other gizmos.One of the root causes for the complexity is that they try to do too much and mix in a variety of products, customers and competitors together. By trying to create the mother of all value models, you lose clarity. It’s better to start with a simpler use case of just one type of customer and competitor. Chances are that 80% of the value will be common to all the other cases and you’ll save time and have better output.Sometimes I find that the complexity is caused by a lot of technical information that doesn’t relate to the customer operations or go-to-market strategy (as we just discussed). The complexity actually hides the fact there isn’t much customer insight. For example, in one spreadsheet I reviewed, I actually saw a value for supplier reputation tucked in there being worth $1 a pound – where did that come from? And that’s another issue. Spreadsheets like this aren’t very transparent nor good for sharing and collaboration. Also, it’s not unusual to find calculation errors buried deep within, so I rarely trust spreadsheets at face value.Unfortunately, there is a tendency for companies to hold onto spreadsheets like these for years. There’s this curious bias about spreadsheets – the more complex they are; the more other people tend to trust them. This is especially so when people are uncertain of their understanding about their customers or aren’t very experienced in thinking about customer value. For example, if I were to give you two numbers: 9.875 versus “around 10” – you think 9.875 is more accurate because it sounds precise. But that’s a fallacy. Without the clear, transparent logic of where that number comes from, “around 10” is a much more practical and honest number.A best practice when building models like this is to make them fully transparent and understandable. A competent value analysis need not be this complicated. It can be done with just a clear understanding of the competitive reference cost and just 2 or 3 solid value drivers. That’s it!

Death by Data. Sometimes when companies get over their inhibitions about value estimation, things can get out of hand and you get death by data. Usually the weapon of choice is a spreadsheet – often created by some long ago anonymous expert. They are loaded with tabs, pivot tables, and complex what-if scenarios and other gizmos.One of the root causes for the complexity is that they try to do too much and mix in a variety of products, customers and competitors together. By trying to create the mother of all value models, you lose clarity. It’s better to start with a simpler use case of just one type of customer and competitor. Chances are that 80% of the value will be common to all the other cases and you’ll save time and have better output.Sometimes I find that the complexity is caused by a lot of technical information that doesn’t relate to the customer operations or go-to-market strategy (as we just discussed). The complexity actually hides the fact there isn’t much customer insight. For example, in one spreadsheet I reviewed, I actually saw a value for supplier reputation tucked in there being worth $1 a pound – where did that come from? And that’s another issue. Spreadsheets like this aren’t very transparent nor good for sharing and collaboration. Also, it’s not unusual to find calculation errors buried deep within, so I rarely trust spreadsheets at face value.Unfortunately, there is a tendency for companies to hold onto spreadsheets like these for years. There’s this curious bias about spreadsheets – the more complex they are; the more other people tend to trust them. This is especially so when people are uncertain of their understanding about their customers or aren’t very experienced in thinking about customer value. For example, if I were to give you two numbers: 9.875 versus “around 10” – you think 9.875 is more accurate because it sounds precise. But that’s a fallacy. Without the clear, transparent logic of where that number comes from, “around 10” is a much more practical and honest number.A best practice when building models like this is to make them fully transparent and understandable. A competent value analysis need not be this complicated. It can be done with just a clear understanding of the competitive reference cost and just 2 or 3 solid value drivers. That’s it! Assuming that value is a single & timeless number. One misperception I often encounter is that value is a scientifically proven number. Many product managers who have scientific or engineering backgrounds may assume this is the case. Their product’s technical specs are scientific, therefore they naturally assume that quantified value is similar.Probably pricing consultants have unwittingly promoted this notion because of statistical price optimization analysis and software. There is a thing called “Pricing Science,” but that has nothing to do with customer value. Rather, pricing science is about transactional analysis. It’s different from value. You need to appreciate the fact that Value is based on economic theory, which is a social science not physical. Newton does not have a third law of value quantification.This doesn’t mean that it gives you license to just make up any numbers. Rather the burden of proof is much like our legal system. Evidence and logic. Make the business case. Test the business case. Never assume that a value estimate is a “one and done affair.” The value of your product changes whenever your customer’s business changes, when new competitive alternatives appear, and so on. So you should review your value at least once a year.

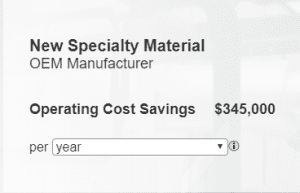

Assuming that value is a single & timeless number. One misperception I often encounter is that value is a scientifically proven number. Many product managers who have scientific or engineering backgrounds may assume this is the case. Their product’s technical specs are scientific, therefore they naturally assume that quantified value is similar.Probably pricing consultants have unwittingly promoted this notion because of statistical price optimization analysis and software. There is a thing called “Pricing Science,” but that has nothing to do with customer value. Rather, pricing science is about transactional analysis. It’s different from value. You need to appreciate the fact that Value is based on economic theory, which is a social science not physical. Newton does not have a third law of value quantification.This doesn’t mean that it gives you license to just make up any numbers. Rather the burden of proof is much like our legal system. Evidence and logic. Make the business case. Test the business case. Never assume that a value estimate is a “one and done affair.” The value of your product changes whenever your customer’s business changes, when new competitive alternatives appear, and so on. So you should review your value at least once a year.- Using the Wrong Metrics. Anyone who has worked with me knows this is a pet peeve of mine. It happens when you try to show customer value using your product’s pricing unit of measure. Here’s a pop quiz:Let’s say you sell paint to a large OEM of consumer appliances. You do a value model and find three specific ways of reducing their operating costs. Question: Which is the best unit of measure for showing these operating cost savings?Is it a (A) Cost per Gallon, because that’s how you sell your paint?

Or do you think a better customer unit is (B) Cost per Year?

Or do you think a better customer unit is (B) Cost per Year?

Again, which do you think tells a more compelling customer story – savings of 23 cents per gallon can of paint (A), or operating cost savings of $345,000 a year (B)?

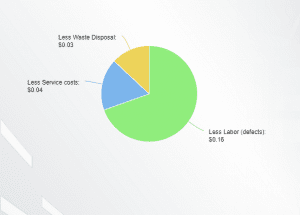

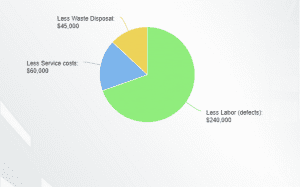

I think it’s fairly obvious that B is a better choice. It makes sense to talk about labor costs or waste disposal or service costs on an annual basis – or perhaps some other customer KPI, like cost per finished appliance. The problem with using per gallon is that it’s a pricing metric that usually only the procurement manager cares about. Tell him or her that you save them 23 cents a gallon, and he or she will automatically assume that you are giving a 23 cent discount off the competitor brand. And that’s probably not the case, because all of this differentiation value costs money to begin with – cost that your competitor did not invest here, so unless you capture some value in your price, your company’s bottom line will suffer.

Remember: your customers only get value when they actually use your product, not when they buy it. So the best value unit of measure is one that is aligned with the customer’s use.

No Validation or Iteration. This occurs when you think of value as a one-time, “one and done” exercise without testing it with sales channels or customers. In other words, YOU determine customer value, make your decisions and essentially toss the product over the wall for the marketing and sales team to worry about.Tossing over the wall doesn’t work, nor does holding back and working in isolation until the last minute. Don’t wait – iterate! Use an agile approach. Test your value hypotheses as early and often as possible before you go to market.One reason Product Managers hold back is because they “don’t have the right data,” but you need to test value hypotheses to figure out what data you need in the first place. This requires you to be pro-active in your collaboration with colleagues, especially in downstream functions like marketing and sales. Even better – find opportunities to test value hypotheses with customers directly. It’s amazing when you approach a customer in a non-selling, research mode to give feedback. It will validate or change your thinking about, (1) what are the customer’s major business issues, and (2) whether your solution uniquely addresses those.We find that just a few iterations can make a tremendous difference in how well value is communicated to customers and most importantly, accepted by customers.

No Validation or Iteration. This occurs when you think of value as a one-time, “one and done” exercise without testing it with sales channels or customers. In other words, YOU determine customer value, make your decisions and essentially toss the product over the wall for the marketing and sales team to worry about.Tossing over the wall doesn’t work, nor does holding back and working in isolation until the last minute. Don’t wait – iterate! Use an agile approach. Test your value hypotheses as early and often as possible before you go to market.One reason Product Managers hold back is because they “don’t have the right data,” but you need to test value hypotheses to figure out what data you need in the first place. This requires you to be pro-active in your collaboration with colleagues, especially in downstream functions like marketing and sales. Even better – find opportunities to test value hypotheses with customers directly. It’s amazing when you approach a customer in a non-selling, research mode to give feedback. It will validate or change your thinking about, (1) what are the customer’s major business issues, and (2) whether your solution uniquely addresses those.We find that just a few iterations can make a tremendous difference in how well value is communicated to customers and most importantly, accepted by customers.

Avoid these common missteps, and you’ll stay on the right road to a better value strategy.