In July, we did a webinar to share insights about improving the success of new product launches which was summarized in this earlier blog Nailing the Successful New Product Introduction. We also received several excellent questions during the webinar. Below is a recap of the Q & A session.

Our marketing people are very focused on our brand perception as a high-quality provider. How do value propositions fit here?

They fit really well because when are talking about things like brand or quality, these all have an economic impact. Think about what a strong brand means –or the reverse of that, what a weak brand means – then you go from there.

For example, let’s say you provide higher quality equipment and you’re more reliable. Well to a customer that means you’re reducing the amount of downtime when the equipment is not working. You can actually estimate a cost for that. You can also look at maintenance costs, repair costs, etc. I believe a strong brand can easily translate to a lot of very tangible reasons why customers buy.

How would you address the situation when your product creates a significant amount of value for the end-user, but your immediate customer (between you and the end-user) does not gain a lot?

This is a very common situation in the B2B world where you are selling through different stages of the value chain. The most important thing to recognize here is that the value of the same exact feature is different to each part of the chain.

For example, if you are selling lighter weight material to a manufacturer who makes parts for an aircraft builder who in turns sell to an airline – there’s a whole chain of benefits that go through there. So you need to understand what value means to each one of them. It’s obvious that the airline gets the benefit of lower fuel costs because of lower weight; yet it’s also true that your part manufacturer customer can leverage their expertise about this new material to become a preferred vendor (to the aircraft builder) which can lead to higher orders and/or higher prices for their parts.

Here’s an organizational question. How do I get people motivated about doing value propositions? What can you say about other company experiences in terms of the ROI of doing this as part of a product launch?

It’s well worth the effort. We put together a case study (see The ROI of Pricing, chapter 12: “Making the Case for Value-Based Pricing Software). One finding is that a company saw at 2-4% increase in gross margin. Now if that isn’t a motivator, I don’t know what is.

How long does it take to construct a good value proposition?

How long does it take to construct a good value proposition?

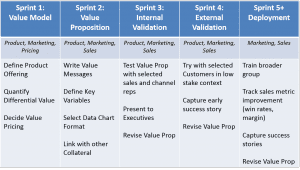

We can do them very quickly. Earlier I showed a slide about the agile approach we use that has a 4 to 6 week schedule. That means by the second week you have a draft value proposition that you can begin to test. Now the one thing you don’t want to do is in the second week is to take that value proposition out and use it on a major deal. Rather you want to iterate that draft, so the following weeks are dedicated to both internal validation, and then external validation.

You can move these things as quickly as you want to. It’s just a matter of commitment and resources.

How do you embed value early in the Stage Gate process, particularly in the R&D phase when you don’t have product specs yet?

The value modeling process helps a great deal to organize the thought process because you are making decisions about which features and functionality you are putting into a brand new product. Often these are based on some sort of value hypothesis.

What’s nice about using a value model to do that is that you can very easily brainstorm and map features and benefits to economic impacts and then you can begin to prioritize them. I think the earlier you do it; the more time you save in later stages. You don’t want to be heavily invested in the feature and find out later that customers may like it, but are not willing to pay an additional price for that especially after you spent part of your R&D budget. So doing modeling early is very valuable.

What do you do about resistance from compliance and legal departments about using value in sale?

My first response is that value is no different than any other kind of marketing content. You have to go through the same vetting process.

From a CFO perspective, product material claims is a standard marketing challenge for any product in any industry. Every industry is a little different. The very highest standards are set in the healthcare industry with the FDA and DDMAC. That may make the issue different here than in other sectors.

But there are a bunch of things to realize. The first thing is that the problem isn’t the value proposition -it’s often the spreading and relatively under-regulated spreadsheets because so often the business case need to be made during the sale process. That it will just happen. And so the important thing to start with my Compliance department is how do I give my sales people something that has been actually thought through and been vetted. It should have disclaimers on it. And I quoted some decent sources.

The problem more often than not is really the quality of what’s out there, it’s not the value propositions themselves. So having some way to standardize the publication process for what’s a live tool, to make sure there is good quality control, to make sure it’s well proved with disclaimers. That’s the best way to get Compliance and Legal on board.

How should we get started in building value propositions and quantified value tools? Whose job should it be?

Product managers need to take that leadership role and driving that process. It’s their responsibility to pull together the team from marketing, sales, pricing or elsewhere to begin that process of modeling and iterating. But we’ve seen other people fulfill that role. You don’t necessarily need to be a product manager. For example, we’ve seen project managers and 6-sigma managers do this type of role.

The main thing, behaviorally is to be committed and to drive to get that information and collaborate with the team and document it. One thing that the value modeling process does very well is that it pulls in a lot of the great ideas the team has and puts it into something that you can actually work and see. The output of that goes directly into the value proposition. You need to keep your eye on the prize and make sure that is happening. There’s no point in going through this exercise if it doesn’t get in front of a customer. Ultimately that’s important to deliver.

Shouldn’t this really be Sale’s job to quantify value? Don’t good sales reps do this already on a napkin or whiteboard?

Well any sales person who does that is worth his or her weight in gold. So the first thing I would do is spend more time with them because that’s a successful sales person who really knows how to translate the value messages into something into something that is relevant to the customer.

The real answer is that it’s really not their job to do that. It’s the product marketing team job to put that together. Now they need to get that input from salespeople. They are the great internal validators of logic and numbers. They will tell you very quickly whether something sounds bogus or not. They know best.

Now if you have a sales person who is already doing value selling then it’s just a question of scaling up what they’re doing and building upon it.

How do you recommend focusing on value pricing and value communication efforts between new product launches versus existing business?

That’s a great question. Companies that are heavily investing in R&D and innovation make new products their priority because it’s really their future. You only have that one chance to get established in the market place with the right positioning and with the right price.

Now what we’ve been seeing with our customers in LeveragePoint is now that they have gotten value embedded into their StageGate process, they do want to look at their broader portfolio. We’re seeing a lot more interest there. With mainstay products, especially in maintaining customer relationships is really important. So it really does depend on your company’s specific situation. New products definitely and then strategic products in your portfolio.

Another perspective is that the mix depends on the mix of strategic products. Invariably many new products are strategic but also there are core or anchor platform products. So sometimes what you see is that value gets focused there with existing customers. So you’re looking with those customers to layer in extra value from the next strategic product. One of the things we see are solution consultants starting with the core and building out from that.

The most important thing when considering where to start is to start somewhere where it really matters and where you can be successful.

Question about pricing systems. First, what’s more important pricing analytics done through price management systems or value pricing and value propositions?

If we’re talking about new products, then price management or analytics isn’t going to be of much use because you don’t have the transaction data. So here, value models and value propositions are way more important.

With existing products, it really depends on the company. Some companies definitely need price management systems to manage discounts and margins especially in this slow-growth economic climate. Companies do spend a lot of money on these type of systems. The value proposition in comparison is a low spend and is actually faster in producing results.

I really don’t see this as a trade-off. Companies ought to be doing both. Pricing analytic tools help you understand the data and make continuing decisions. Value propositions helps sales sell. Those are complimentary roles.

How do you compare value propositions versus CPQ (configure, price, quote)?

It was interesting that at the PPS (Professional Pricing Society) conference last month, I was surprised to learn that CPQ is a much bigger play now in the pricing world. A lot of companies are looking at these systems. The thing I would be thinking about I where am I leaving money on the table?

Instead CPQ systems are all about sales efficiency – getting quotes out as quickly as possible. How to respond to a customer quicker with a standard proposal – to win the game. That may be true, but are you really leaving money on the table because you’re not communicating value? You may get the bid out, but if the customer pushes you for a discount because you fail to get value messages across, or are they just using you as a comparison bid, that doesn’t improve your product positioning. CPQ is all about making more efficient this world of increasing customization of a solution. As that happens, CPQ helps sell through speed. What value propositions do is help sell through making a business case. Again, I think this is a complimentary system to value propositions.

In constructing a value model, do you use a spreadsheet for your calculations and to capture assumptions?

No. We’ve converted a lot of spreadsheets into LeveragePoint value models. You know there are huge advantages to having this in a common database that is searchable, accessible, secure etc. All those reasons which are described in the whitepaper about spreadsheets.

When we rip apart a spreadsheet that has layers of look-up tables and whatnot, Lord knows what’s in there. So you don’t need to have offline tools to accompany a value model. They can all be embedded in a common database.