Leading B2B enterprises embed customer value early and often in their new product development, pricing, and product management processes. But why is it so critical that they incorporate value from the beginning? By not only identifying, but also quantifying, the financial impact their solutions deliver to their customers, organizations will make better product development and prioritization decisions, leading to greater product launch success and maximizing the profitability of existing solutions. These benefits carry forward into the go-to-market process, as the ability to communicate this value in marketing content and in sales conversations transforms better B2B decisions into profitable ones.

When we put together the 2022 State of Value Management Survey, one area we were keen to explore was exactly when in the commercial delivery process value was being embedded, and how consistently it was incorporated across several key stages in the commercialization process. We hypothesized that introducing value in earlier stages allowed for higher levels of integration and value realization. Through the survey results, we observed:

- B2B companies are broadly seeking to embed value across the stages of the commercialization process.

- Certain sectors, such as Healthcare/Medical Devices and Specialty Chemicals and Oil & Gas have embedded value in earlier stages relative to others such as Logistics.

- Companies that excel at value management focus on quantifying their differentiation value against their competitors and other relevant alternatives.

- Centralized value functions, in the form of a value office or individual mobilizers, play a major role in driving team-wide adoption of value management principles

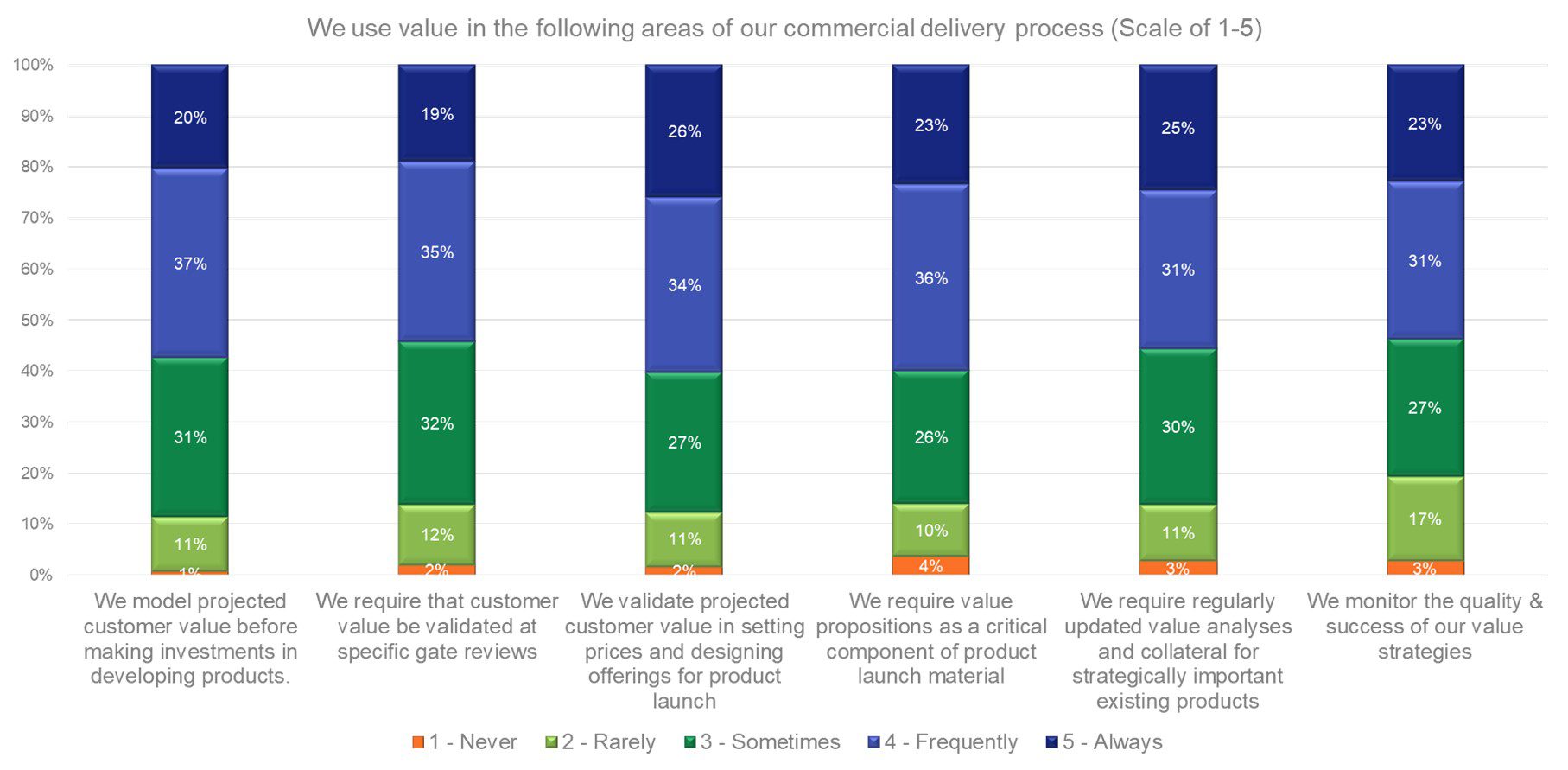

In the survey, we asked how frequently value was incorporated in initial investment decisions, pricing and offer design, the stage gate process & product launch, as well as in existing product management. Overall, the audience responses were consistent across each of the identified stages, which spanned the innovation process.

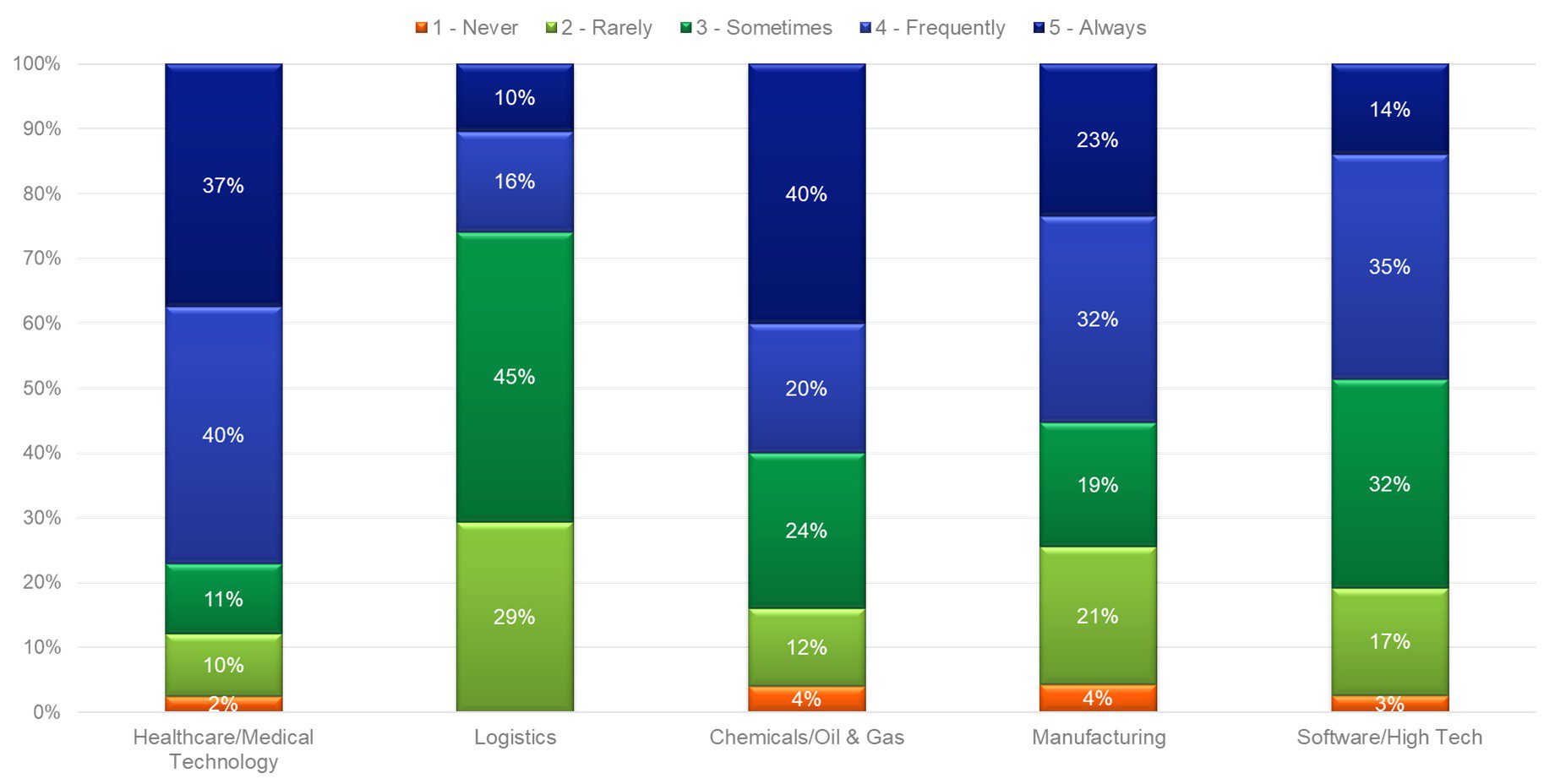

For each question, over half of respondents indicated that value was frequently or always used in each stage. While these findings were consistent with an audience with a strong value-focus, a deeper dive across verticals sheds some interesting light on varying levels of adoption across different industries.

Value practices vary by industry

Overall, we found that some industries – healthcare/medical technology in particular but also chemicals/oil & gas – were quite mature in their adoption of value management best practices, whereas manufacturing and software/high-tech tended to fall in the middle of the spectrum, with logistics lagging behind. We explored these findings in detail with our panel.

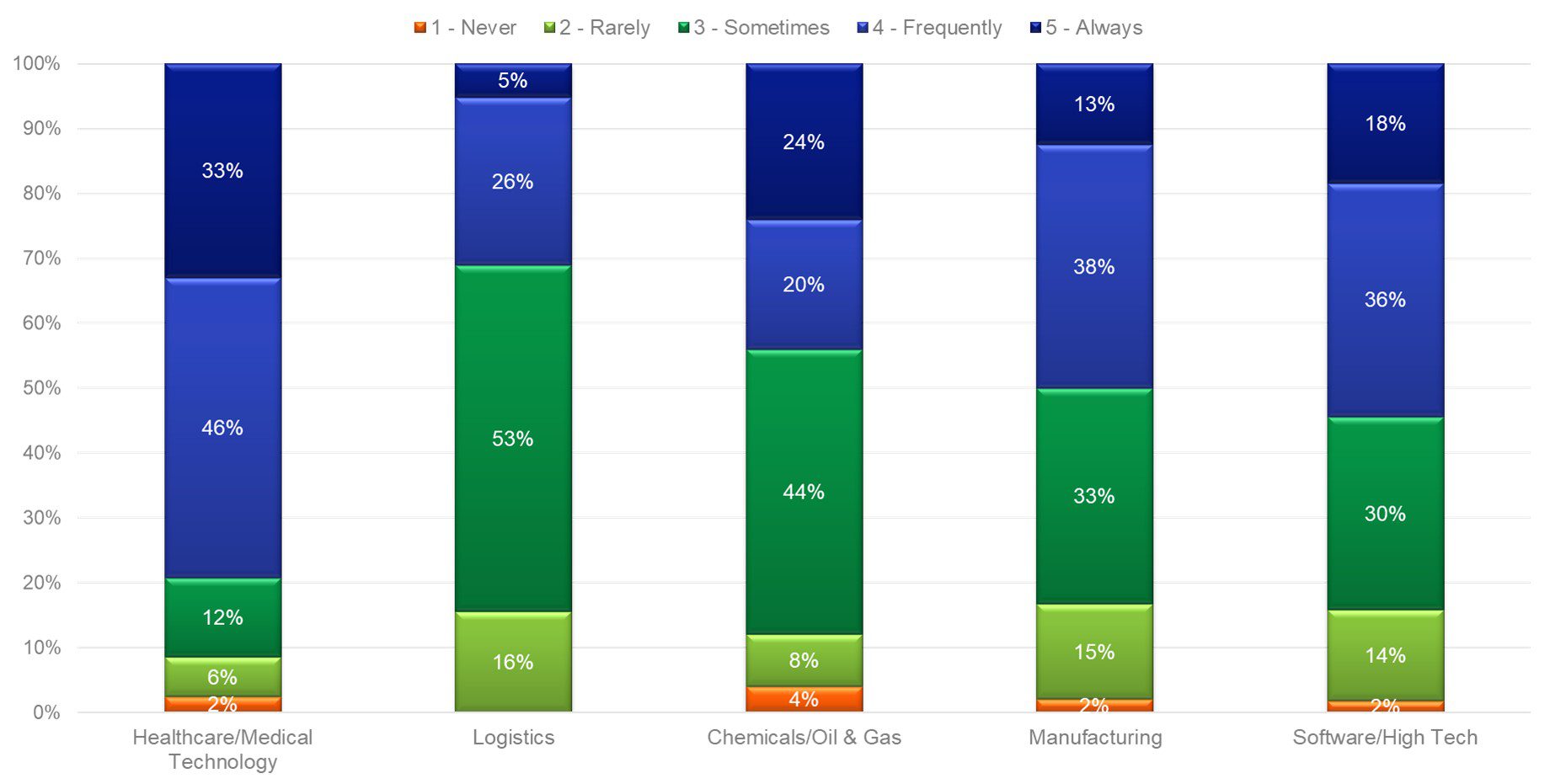

- “We require that customer value be validated at specific gate reviews.”

We found that the Healthcare/Medical Technology sector was by far the most disciplined about incorporating customer value during the gate review process (where new products in development must clear certain criteria before advancing to the next stage), with 79% of respondents indicating that it was frequently or always used. The maturity of this sector, relative to others, makes sense when considering the high R&D costs and degree of regulatory compliance inherent in this space.“In the healthcare and medical world, the cost of failure is so high,” observed Todd Snelgrove, Founding Partner at Experts in Value. He added, “because of the payment model in some of the markets, insurance companies are going to pay for quantified value, not a brand or a feeling, so to sell something into that world, you better have a business case.”

“We require that customer value be validated at specific gate reviews.”

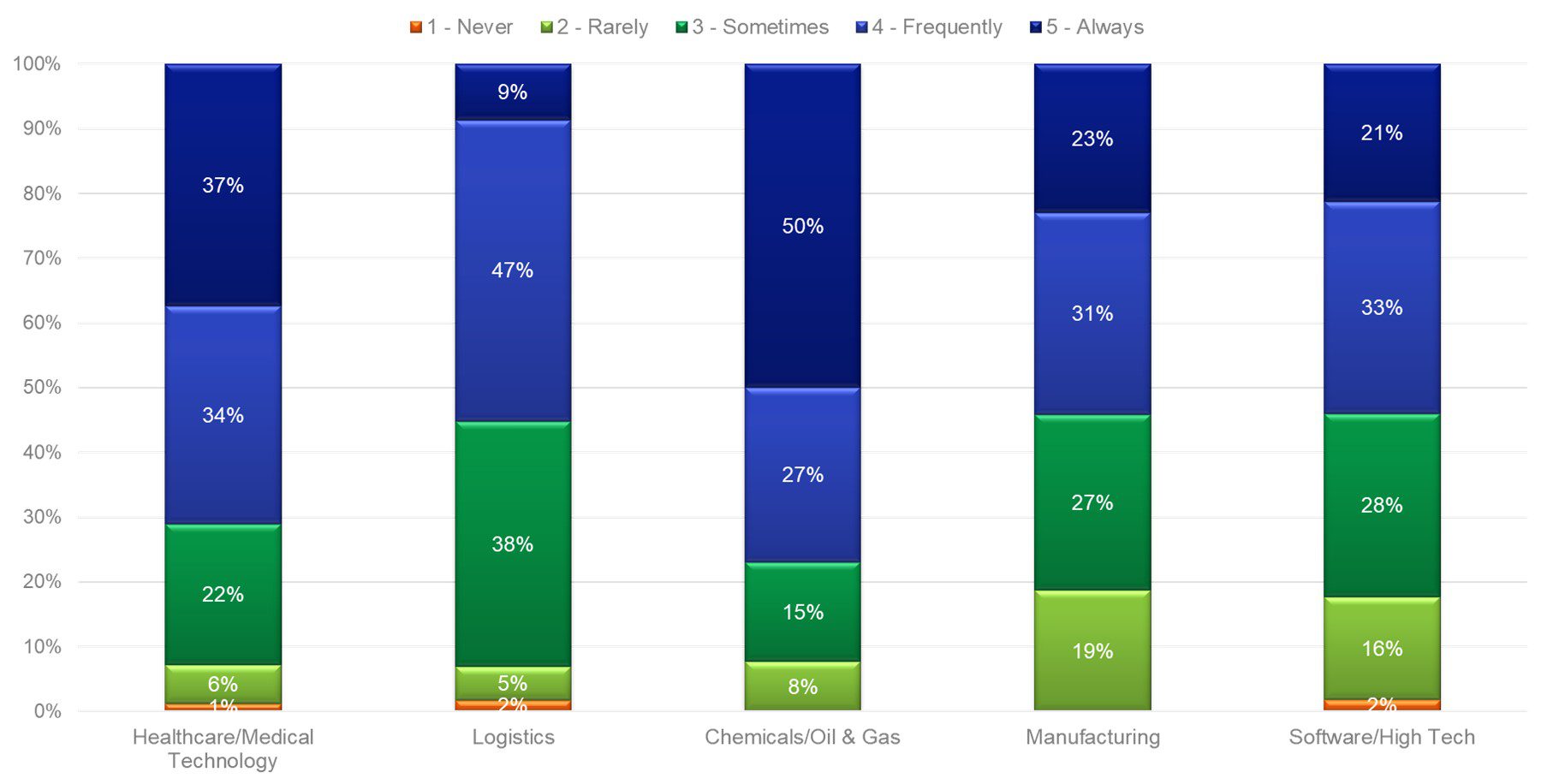

- “We validate projected customer value in setting prices and designing offerings for product launch.”

Healthcare/Medical Technology again stood out for their early-stage value management execution, but the most interesting finding was the degree of sophistication in Chemicals and Oil & Gas industries, where 77% of respondents frequently or always incorporated value in their price setting and offer design processes. This sector has long had a strong tradition of value-based pricing, which makes the survey findings quite logical – echoed by an industry expert on our panel.“Value when launching a new product is very, very important for us,” shared Paolo de Angeli, Head of Customer Experience and Customer Value Management at Borealis. “You need to get [it right] the first time – if you launch a product and you don’t do your value assessments and you are not able to understand why customers should buy this new solution, then you’re not starting well. We have a formal process at Borealis: whenever you launch a new product, you need to go through a value assessment with LeveragePoint. If you are not able to show how much more money our customers are supposed to make with this new solution, you simply cannot go forward. And I think it’s a pretty simple but effective way to embed customer value management in our commercial processes.”

“We validate projected customer value in setting prices and designing offerings for product launch.”

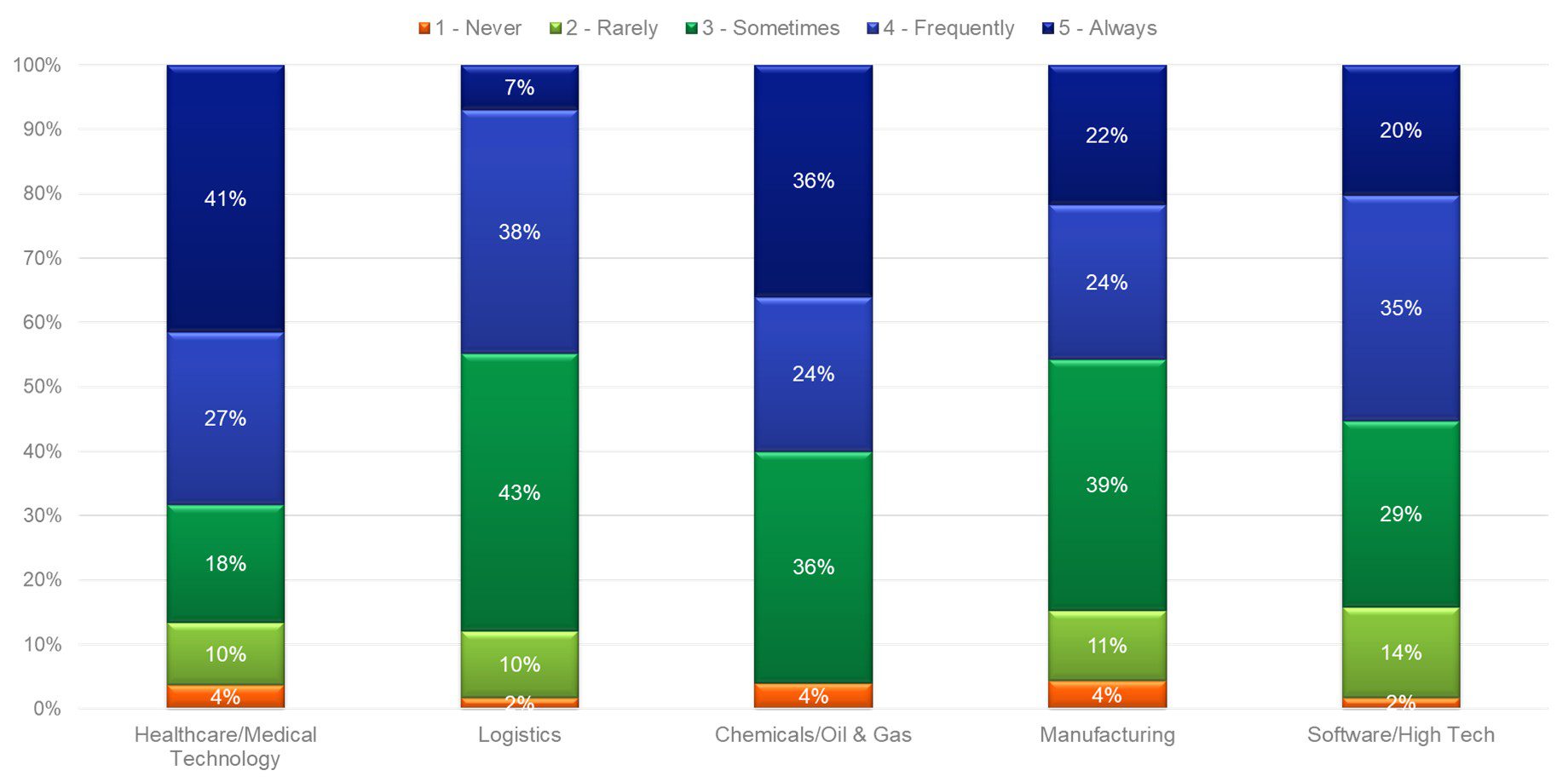

- “We require regularly updated value analyses and collateral for strategically important existing products.”

When asked about the role value plays in supporting the commercialization of strategically important existing products, we found that while healthcare and chemicals and oil & gas continued to excel, there were encouraging signs from the software/high-tech space, with 55% of respondents indicating that they use value frequently or always. The nature of this industry, particularly software, is one of frequent and iterative improvement of existing offerings – increasingly deployed via the cloud. For these companies, continually analyzing value delivered in order to update their value drivers and downstream value content is critical to continued commercial success.Underpinning the continual updating of customer value analyses and content is the importance for B2B companies to quantify and communicate differentiated value in a world of ever-changing features, services, and market conditions.

“We require regularly updated value analyses and collateral for strategically important existing products.”

“For all differentiated products where there’s a clear benefit to the customer it is imperative to quantify value,” shared Ole Iacob Prebensen, Global Marketing Manager at Elkem. “It might not be straightforward, but even if an analysis or a value model hasn’t been done in the past for these existing products, use the case studies that you [already] have and quantify (or dollarize them) as someone and make a value model – use the best available numbers you have on hand.The benefit? “My experience is that this will trigger an organizational mindset when you look at differentiation as opposed to product costs,” he shared. “Regular updates on these models will allow you for broader understanding of the overall benefits of these products as well.”

- “We monitor the quality & success of our value strategies.”

The final question in the value management category sought to capture the degree to which companies measure and track the success of their value management initiatives. It was somewhat unsurprising that the industry-by-industry responses on measurement closely tracked the responses on the stages where value was deployed. On the whole, we saw healthcare/medical technology outperform other industries, followed by chemicals. A consistent finding was that logistics consistently came last in terms of value utilization. In this case, only a quarter – 26% – frequently or always measured the impact of their value initiatives.Over time, it will be interesting to see if the logistics sector increasingly adopts value-based strategies that have been proven successful in other B2B verticals, especially as high-value, differentiated offerings (such as real-time tracking and just-in-time) become more common in a world where efficient, resilient supply chains are more critical than ever.

“We monitor the quality & success of our value strategies.”

Our panel agreed that tracking success is critical. “it’s very, very important to measure success,” insisted de Angeli. “If we cannot prove that [our solution] is delivering money for our customers then [value management] is a nice exercise but not a complete one.” So how do we measure success? In my experience it’s always about doing so relative to a next best alternative. We implemented a peer comparison analysis, [where] we compare the performance, volume, price, or margins of the customers we visited with these [value-based] methodologies versus similar customers in the same region that we didn’t, and then we measure the impact. We were able to measure pretty interesting outcome when we first did this for new products.”

In scenarios where it’s impossible to compare outcomes – especially in the early stages, de Angeli recommended a different approach. “The next best alternative is asking your marketing manager what price he or she would set the solution before going through a customer value management exercise. Then, after you do the quantification, you compare. Very often you will find more value and higher target prices based on this exercise.”

Identifying and Quantifying Differentiation

The survey responses indicate that B2B companies across all verticals are attempting to incorporate value strategies in their commercialization process to varying degrees. To do so effectively, this quantified value must be customer specific – using as much of their own data as possible, and, as de Angeli stressed earlier, presented against a reference alternative. This can take the form of either a competing solution or the simply the status quo. Our panel stressed the importance of identifying, measuring, and communicating differentiation as part of a successful value management process – even in scenarios where it’s not simple.

“When you have specific [differentiated] features, it’s no brainer,” shared Prebensen, “but where you don’t have them – I hate to use the term ‘commodity products’ but let’s use it in this case – my recommendation is to find the intangibles that the organization can contribute and make them tangible. In other words, for lab services, you might have speeded delivery, for example, or even the trust factor and reliability of your own company. Use that and create the value drivers that you need in order to turn a commodity product into a specialty one.”

De Angeli concurred, suggesting that organizations who perceive themselves as providing commodity offerings are doomed to realize commodity prices. “The concept of commodity is a self-created concept that comes from laziness – not taking the time to look at every single element of your value proposition,” he shared. “We have to keep on repeating within our organization that intangible [value drivers] are just as important as the product related features. Many organizations have been investing a lot in technical services, customer services, and brand. It’s not impossible to quantify these elements. Maybe it’s more difficult – very difficult in some cases. Maybe we fear going to customers to talk about these elements because we fear their reactions. But it’s very important to spend time on this because that’s where sometimes companies really are differentiating themselves from others.”

A centralized value function is key in helping B2B organizations align around differentiated value, whether in the form of a value office or a mobilizer tasked with embedding these principles across the commercial team. “I think the value management office, or whatever that team or person is called, needs to provide that customer perspective, and to embed those systems processes along the way,” Snelgove shared from his experiences. “What eventually did was support the product development people, pricing people, and the rest of the team, but also ask [questions] from the customer’s perspective. Have somebody make it part of their job – there to support but also be the challenger.” Incorporating this into new product development and product management processes helps avert missteps before they become more expensive. After all, “it’s really tough if after launch, and you have spent all this money on it, to come back and say, ‘now we’re going to reposition [our offering].’”

At what stages of commercialization does your organization introduce value management practices? Check out our other posts in this series and stay tuned for future updates as we explore how these value management principles are being applied by B2B companies in the marketing and sales process.

- What is a value proposition? How do participants define value management and value selling?

- When in the sales process are value selling tactics deployed?

- How are leading companies embedding customer value in the sales process?

- What are some useful ways for individuals and organizations to improve their value management efforts?

- Survey Overview