Physical navigation has come a long way in 500+ years. Instead of envisioning the edge of the world, the disembodied voice on our iPhone saves us from traffic, telling us to turn left at the

next intersection. The technology of creating and using maps has been central to our progress in navigating an increasingly complicated geographic landscape. Yet, as tactical navigation apps both wow us and spoil us, we neglect to take the time we took a generation ago to look at the map and deliberately plan our route.

next intersection. The technology of creating and using maps has been central to our progress in navigating an increasingly complicated geographic landscape. Yet, as tactical navigation apps both wow us and spoil us, we neglect to take the time we took a generation ago to look at the map and deliberately plan our route.

The strategic landscape for commercial teams has also become more complex. In the face of buyers with superior information, sales teams scramble to engage with buyers working their way through an opaque buying process. In the face of accelerating innovation, marketing teams grapple with how to respond to competing solutions and ever-changing customer applications. In the face of our own development work and new product releases, product managers sprint to keep their content current, unable to pause and reflect on their product landscape.

Business complexity compels us to spend our bandwidth responding tactically when we need to find the time to think strategically. C-suites in great organizations understand that they need to implement and enforce disciplines that provide strategic insights and require strategic perspectives. Successful enterprises strive to improve the tools and technology they use to navigate markets. Value Maps are a great first step that provide strategic insights to help improve performance.

Business complexity compels us to spend our bandwidth responding tactically when we need to find the time to think strategically. C-suites in great organizations understand that they need to implement and enforce disciplines that provide strategic insights and require strategic perspectives. Successful enterprises strive to improve the tools and technology they use to navigate markets. Value Maps are a great first step that provide strategic insights to help improve performance.

Start Navigating Strategically: Some Key Questions. Product strategy takes time, but a small investment in understanding our customers can yield important insights. For any product, we should start by answering the following questions:

- What market do we address? Who are our customers?

- What do our customers do with our product? How does our product fit into our customers’ business? How does our product matter to our customers’ customers?

- What alternatives to our product or solution do our customers consider? Do they consider our own products in addition to those of competitors?

- What are the prices of the alternatives in our market on a comparable basis?

- How do our product and its competitors compare in terms of product features and performance? More importantly, how do the alternatives compare in terms of the benefits they deliver to customers?

As management, we need to ask our teams these questions regularly. They are central to good product strategy and to strong product positioning.

Whose Perspective? Answers to these questions support a good Value Map, but we need to be aware of whose answers they are.

- There are our own perspectives on our market, our own view of product performance and benefits and even our own view of prices. Regardless of the biases we start with, honesty in making and refining these assessments sustains better strategy.

- Our competitors may have different perceptions of our market. Learning what we can about relevant differences in competitors’ perspectives can’t hurt even if this kind of competitive intelligence is hard to obtain and sometimes unreliable.

- What are our customers’ perceptions of our market, product performance, customer benefits and product prices? This perspective helps us understand what matters to the audience who matters. After all, customers determine winners and losers in the market.

Exhaustive research from different perspectives is nice, but not necessary. If we don’t have well-articulated views of our own, we should start with our own perspective. Having developed our honest views and a basic framework, conducting market research on customers’ perceptions is useful if we have the resources. But good product managers also develop habits, as they speak with customers, of testing their own perceptions and their own Value Maps. Our aim, regardless of available resources, is to understand customers’ sensitivity to quality and price.

What if we learn that our perspectives differ from those of our customers? This creates an opportunity to reconsider and refine our perspective. It also creates the possibility that we will benefit from marketing campaigns designed to change customer perspectives. Finally, it may help guide our own decisions on product positioning, pricing or new directions for product innovation that more effectively address the market.

What if answers to the key questions are inconsistent with market outcomes? If the dominant product in our market or a product gaining market share lacks advantages in perceived price and/or perceived benefits or value, then perhaps our perceptions need to be reassessed or our customer interviewing techniques need to be refined.

Value Maps – A Framework to Understand Our Positioning. Honest answers to the key questions from any perspective are useful. As raw data, they help us understand our differentiation and our positioning at a qualitative level. But it is more impactful to bring them together in a framework that helps visualize our product’s positioning in the market. Value Maps provide a useful framework that has been used since Bradley Gale’s Managing Customer Value in 1994, work by McKinsey a few years later and in analysis by many companies and many consultants since.

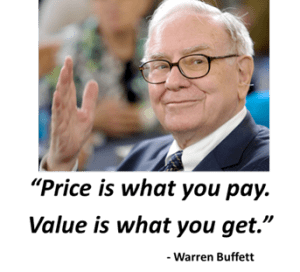

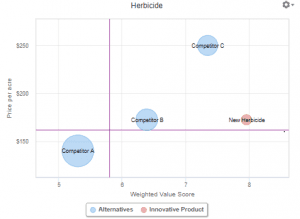

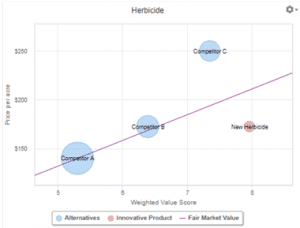

A Value Map is a simple two dimensional framework that organizes the key information into Warren Buffett’s two categories: “Price is what you pay, value is what you get.” A Value Map clearly specifies the market in terms of customer type. Sometimes a value map is specific in terms of application of our product as a means to understand a narrower segment.

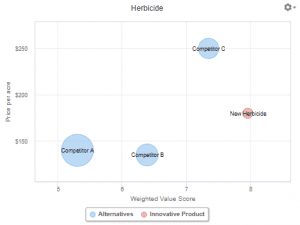

The usual value map displays product prices on the y-axis where prices are converted to a common unit. Value Maps generally show product features/ performance/ benefits or value as a score on the x-axis.

A good value map plots a point for each product in the market and uses bubble sizes to represent each product’s market size or relative market share.

Points in the scatter plot down and to the right in a Value Map represent better value for money. If the Value Map’s assessment is a sound one for this market, then these are the products that should be gaining market share over time.

Measuring Product Value in a Value Map. The primary work in creating a value map is to come up with a score that measures performance, benefits or value quantitatively in one dimension. An overall value score is generally derived as a weighted average of scores attributed to a number of features or customer benefits. These scores are more useful if a few disciplines are followed as best practices:

- List and assess customer benefits. Teams often start with a combined list of product attributes, features and benefits. Understanding differentiation in terms of features can be useful but it is far better to frame the discussion based on what those features mean to the customer. We always learn the most when we reframe our differentiation in customer-centric terms based on benefits to our customers.

- Assign weights for each benefit based on its relative importance. Weights are a means to add up scores to get a single number for the graph. If we knew dollar (or euro) weights from the customer’s perspective, then value measured in dollars and derived from those weights would be directly comparable to price and we would not need two dimensions to compare products. We could just add or subtract to learn which product has the best net value for money. But weights in Value Maps are rarely calibrated financially. Understanding dollarized value by means of Economic Value Estimation (EVE®) or other methods based on objective economic benefits is a better approach to communicating B2B value than are Value Maps. Understanding dollarized value by adding up value based on objective or perceived economic benefits provides a stronger foundation for B2B product pricing than Value Maps. But Value Maps provide a good start based on a reasonable assessment of what is important as the basis for good weights.

- Assign consistent scores for each product for each benefit. We learn the most from team discussions or customer answers to questions if we capture the rationale underlying their scores. Recording the rationale for scoring is a means to reassess and improve the quality of those scores based on market research or experience.

- Get perspective on the scatter plot. There are several

visual approaches to obtain some perspective on the points in the Value Map. A window pane through the market average point or through the point representing a close competitor helps us visualize how we stack up relative to that reference point. Alternatively, a “Fair Market Value” (FMV) line or “Value Equivalence Line” provides a different perspective.

visual approaches to obtain some perspective on the points in the Value Map. A window pane through the market average point or through the point representing a close competitor helps us visualize how we stack up relative to that reference point. Alternatively, a “Fair Market Value” (FMV) line or “Value Equivalence Line” provides a different perspective. The standard approach is to draw an FMV line through the market average (or a dominant competitor) and the origin on the graph. As a variation, some teams consider a Fair Market Value line with a slope that adjusts for the perceived relative importance of price vs value in this specific market.

The standard approach is to draw an FMV line through the market average (or a dominant competitor) and the origin on the graph. As a variation, some teams consider a Fair Market Value line with a slope that adjusts for the perceived relative importance of price vs value in this specific market. - Test and refine. Test and refine. If we reassess value weighting and value scoring based on how value for money stacks up versus market share or expressed customer views, then scoring that is initially subjective will evolve toward more objective scoring based on customer perceptions. This evolution can provide valuable insights into our market and how to improve performance.

Applying Value Maps. What should we do with our value map? In our subsequent blogs we will review useful applications of value maps in greater detail and consider their limitations and pitfalls. Suffice it to say that a Value Map provides a visualization of our product’s positioning. That perspective provides a basis for further exploration and discussion of topics that include:

- How has our positioning changed since last year?

- Are there pricing opportunities to explore?

- Are there useful perspectives on how competitors will respond to pricing changes?

- Are there marketing campaigns that are suggested by our value map analysis?

- Are there product innovation opportunities to consider?

- What is a reasonable starting point for a next best alternative (NBA) for value modeling?

- What are the critical differentiators our product vs our NBA? Can we dollarize that differentiation?

How Difficult Is Value Mapping? Every team has a different answer to this question. Some teams have high standards for data quality and believe that they need to do extensive market research for Value Maps to have any use at all. There is nothing wrong with high standards for data quality – analyses are only as good as their supporting data.

But the data don’t have to be perfect – extensive market research is not free in terms of time and money. One or two customer interviews are better than no customer feedback. Even value maps  based on a one or two hour internal commercial team session provide valuable information. The exercise of coming up with a value map helps product managers ask hard questions about product differentiation. Building internal team consensus on scores and weights usually provides plenty of lightbulb moments for members of our team as they debate specific differentiation between our products and our competitor’s products. These internally generated value maps are then useful in creating hypotheses to test about customer perceptions. They are also a good first step towards dollarizing (or euro-izing) a B2B product’s differentiation.

based on a one or two hour internal commercial team session provide valuable information. The exercise of coming up with a value map helps product managers ask hard questions about product differentiation. Building internal team consensus on scores and weights usually provides plenty of lightbulb moments for members of our team as they debate specific differentiation between our products and our competitor’s products. These internally generated value maps are then useful in creating hypotheses to test about customer perceptions. They are also a good first step towards dollarizing (or euro-izing) a B2B product’s differentiation.

Even an internal Value Map that is never completed can be informative. If our team can’t build the consensus required for v1 of an internal Value Map, then maybe we don’t understand our customers, our competitors or how our product is differentiated. Or maybe we don’t have a functional team. In either event, management should consider an intervention.

Implementing a product management discipline that requires Value Maps helps drive a common customer-centric framework for product strategy. We can drill deeper than Value Maps in understanding customer value, but they are a good place to start. No matter how clever the voice on our iPhone, maps still help us travel more quickly to our destination.