Value Propositions improve B2B sales team performance, addressing sales challenges throughout the B2B sales cycle. For account executives and sales reps, they are useful early in the sales cycle in call preparation, in building sales confidence, in qualifying opportunities and in engaging customer executives. For presales professionals, joining the customer-facing team in the middle of the sales process, Value Propositions are an important way to address presales challenges and to maximize the impact of presales. Sales and presales teams use Value Propositions to highlight differentiation and cut through complexity as they collaborate with customer stakeholders to build a shared business case to buy. The outcome is often that sales teams can become trusted customer advisors.

Creating Value Content. Value Propositions only work in sales if the embedded value content is clear and simple. Quantitative value content should address some central questions:

- Is our product or our offering better?

- How is it better and how much better is it?

- What is that worth to the customer?

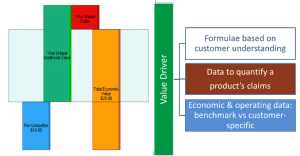

In quantifying value it helps to have a consistent framework. Economic Value Estimation (EVE®) is a useful quantitative framework that highlights differentiation. The starting point

for EVE is a competing alternative which provides the reference point for quantifying our value. Positive value drivers show the value of our specific differentiation and should be called out in a way  consistent with our messaging. It’s always fair to identify and quantify negative value drivers so that sales or presales are prepared to talk about where we might be disadvantaged or where there might be transition costs associated with our offering.

consistent with our messaging. It’s always fair to identify and quantify negative value drivers so that sales or presales are prepared to talk about where we might be disadvantaged or where there might be transition costs associated with our offering.

Adding up the results, before even considering the price of our offering, we get to Total Economic Value and the Differentiation Value we create versus the competitive reference point. Quantified value helps to consider and set prices that capture a meaningful share of the value our product creates. The value that’s left after our price is the Customer Value providing a strong basis for communication. Our product creates value, the customer gets value and the sales dialog can focus on a win-win conversation.

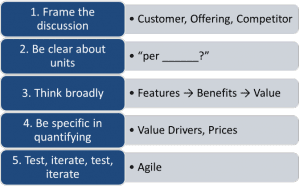

Five Steps to Good Value Content. How do B2B product teams get started in quantifying value? There are five steps to keep in mind that will help generate strong quantitative Value Propositions for sales.

Five Steps to Good Value Content. How do B2B product teams get started in quantifying value? There are five steps to keep in mind that will help generate strong quantitative Value Propositions for sales.

- Frame the discussion. Quantified value only makes sense when the assumptions and frame of reference are clear.

- Clarity on our offering or product. What are we selling? Is it a product, a set of services or a package of both?

- Clarity regarding the customer. Who are we selling it to? What’s the customer’s profile? Is there a specific customer segment we are thinking of as we quantify value?

- Clarity in specifying a competitor. What is the reference alternative? What is the customer comparing us to? The status quo? A competing purchase?

- Be clear about units. Customers want to hear answers quantified in their terms. Value per ____?

Customer finance teams always want answers that match an accounting frame of reference: per year, per quarter, over the life of a project, or over the life of a durable piece of equipment. Customer operating people usually want operating answers: per unit of customer product or per unit of their output.

Customer operating people usually want operating answers: per unit of customer product or per unit of their output.

The best approach is to start with a customer-centric unit. Framing the quantification with one or more customer-centric units becomes a basis for setting up visuals that make sense. Value stacks and waterfalls, expressed in the same unit, can be added up meaningfully and shown graphically. Always quantify value drivers in customer-centric units when the aim is communication.

Confusion often arises when value is quantified in product-centric units – the units that we sell in (eg kg, liters). Value drivers expressed in product-centric units typically don’t resonate with customers and may create misunderstanding. Worse than that, outright mistakes and needless debates can result where we have an “acquisition efficiency.” If, for example, our product is more efficient, more productive or more durable than the competitive reference point, customers may be comparing the purchase of different amounts of the two products or alternatives. In these circumstances, “our kilograms” are not mathematically the same units as “competitor kilograms.” This can get very counterintuitive and can result in conversational chaos.

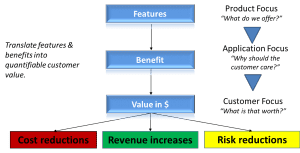

It is always best to start with, communicate and then check both value and price in customer-centric units. - Think broadly in quantifying value. Start with our product features. We have probably made some investments in enhanced features for our product. What are they? How is our product or solution better than the reference alternative?

But then move beyond product to the customer. Consider our differentiated features, then ask how the customer benefits from these features in business terms. Starting qualitatively is good. Generate hypotheses to test. We need to make our internal conversation customer-centric by directing our focus away from our product onto the customer.

Then it is time to be quantitative. What are our product’s benefits worth to the customer? Look at the key customer business parameters that will drive the value and think about the natural way to ask customers questions about these. Generate ideas and starting points for quantification.

Look at the key customer business parameters that will drive the value and think about the natural way to ask customers questions about these. Generate ideas and starting points for quantification.

Initially it is important to be broad in identifying value drivers. We can be selective and think about simplifying/ consolidating arguments and value drivers later. Identify cost reductions. Recognize potential revenue increases. Think about risk reductions. Generate plausible hypotheses to test. - Be specific in quantification. As we think about each value driver, we need to be specific. They are only three elements in a value driver:

- Formulae based on how we understand the customer and what our product does for the customer

- Data that quantify the claims we make for our product or solution

- Background economic and specific customer operating data.

Usually it makes sense to start with benchmark data or data from an early adopter that may be representative. A good Value Proposition is designed to be increasingly customer-specific as the sales process progresses.

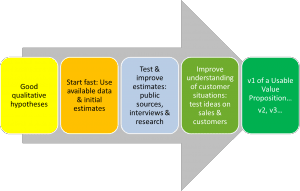

Value is more than measurable cost or other readily quantified items. Value drivers that seem less tangible or more difficult to quantify often include revenue value drivers and value drivers based on risk and brand. Don’t be shy about quantifying them. Creating value content is not a precise science. Value drivers for intangibles can be generated from creative but disciplined questions focused on the customer business as a basis for specific, sensible value drivers. Set up clear formulae with unrefined numbers that can serve as a basis for ongoing refinement.  Test, iterate, test, iterate. Be agile. Start fast with good qualitative hypotheses. Use available data and initial estimates to get to v1 of a plausible quantitative Value Proposition. Having internal conversations and selected customer conversations with the Value Proposition should continue to result in refinements and improvements as v2 is better than v1 and v3 is better than v2. Value Propositions improve in 3 ways if used actively in conversations and if refined based on agile methods:

Test, iterate, test, iterate. Be agile. Start fast with good qualitative hypotheses. Use available data and initial estimates to get to v1 of a plausible quantitative Value Proposition. Having internal conversations and selected customer conversations with the Value Proposition should continue to result in refinements and improvements as v2 is better than v1 and v3 is better than v2. Value Propositions improve in 3 ways if used actively in conversations and if refined based on agile methods:

- Better data quality and plausibility. Data quality can and should evolve. Hypotheses turn into anecdotes. An anecdote is often supported by a customer interview result. Anecdotes and interviews may be succeeded by early adopter case studies. Surveys then come into play as do development studies, outcomes studies and other research. The plausible use of data in sales conversations generates higher quality data for the next sales call.

- More streamlined applicability of the Value Proposition to specific business circumstances. Tightly defining the frame of reference helps initially in getting to quantitative value fast. But along the way, good product teams clarify their customer use cases, making it simple for Value Proposition Users to refine the Value Proposition based on (i) alternative customer situations and objectives, (ii) alternative offering specifics and (iii) different competitive reference points.

- Improved value content layout and access. Testing and using the Value Proposition internally and externally helps provide perspectives on how the Value Proposition should be set up for different customer conversations by different users at different point in the sales cycle. Creating v2 and v3 based on experiences using the Value Proposition will result in continuous improvement in effectiveness.

This requires:

Teams often get hung up on all the possibilities that come up as we frame the discussion. As a result it can be hard to get started. Start somewhere. Keep good notes of any specific choices and assumptions we make as we proceed. Those notes will help later as we broaden the Value Proposition to cover other customer situations, offering packages and competitive situations.

In sum, generating strong quantitative Value Propositions is not rocket science. Product managers can generate great content that can serve as the foundation for useful sales tools by:

- Focusing on the customer

- Thinking creatively and strategically

- Quantifying specifically

- Taking an agile approach

The resulting Value Propositions help sales teams win.