BIG IDEA:

Review your value proposition to ensure your value proposition remains robust in an inflationary environment.

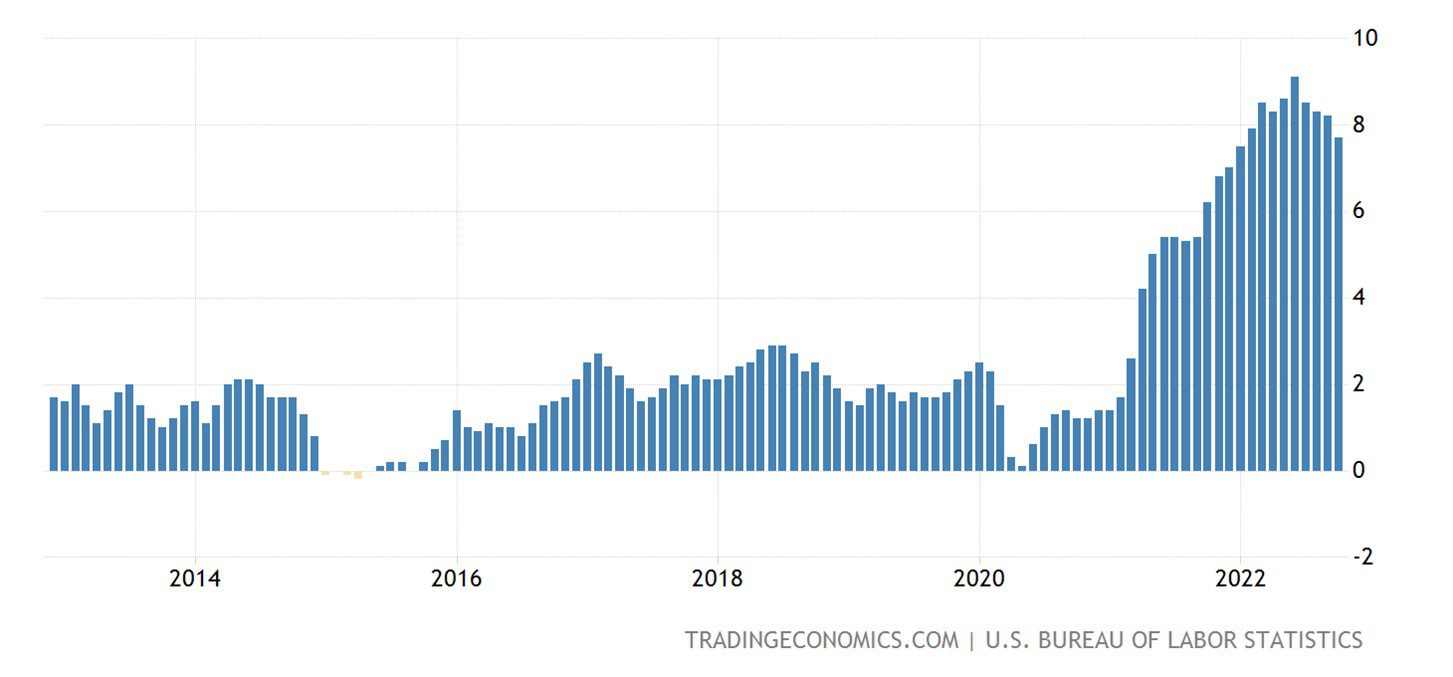

In the last 18 months, inflation has risen to levels unknown in the previous decade. Between 2013 and the first half of 2021 inflation rates rarely rose above 3%. In 2022 however, we saw inflation peak at 9.1% (receding to 7.7% as of October 2022). While levels of inflation, sources of inflation (e.g. monetary or supply chain disruption), and responsiveness to countermeasures (monetary policy, redesign of supply chains, etc.) vary by region and industry sector, most companies are experiencing new and disruptive pressures on their business model.

(United States Inflation Rate, Accessed 11/29/2022)

B2B firms need to think carefully about how inflation and recession conditions may impact not only their business model but also that of their customers. Given the economic outlook for 2023, B2B organizations will likely see the following pressures:

- Firms may start to place greater focus on profitability over market share

- Forward-looking companies may be more interested in trying new innovative approaches and technologies to produce more at lower costs rather than simply accept price increases associated with doing business as usual. Your customers might also find they need to change their cost structures to accommodate greater volatility in demand from their downstream customers.

B2B firms should seize the moment to realign their pricing structure and value propositions to the new market realities

- Does your inflation pricing strategy make sense?

- Does your value story include value drivers that free cash flow? If you offer products or services that allow investments to be spread over a longer time horizon or replace the need to borrow (because they can outsource instead of building in-house), new cost savings can be realized due to higher interest rates.

- Does your value story include value drivers that reduce (rising) costs? In the face of economic headwinds, cost savings will be a key part of an effective value story. Explore savings a customer might realize in terms of reduced waste, reduced energy/utility consumption, and reduced labor (especially in fields experiencing skilled labor shortages).

- Does your value story include value drivers that increase profit for your customer? Explore net new profits a customer could realize in terms of access to new markets, deeper penetration into existing markets, and/or ability to charge more per unit due to superior performance. Sometimes your customers will have to charge more as well to remain profitable, but if your offerings contribute to the quality of their offerings you should be able to claim a part of that additional value.

The bottom line is that value matters, especially in times of inflation.

- Quantify the current value of your offering given recent inflationary pressures.

- Adjust your offering designs and pricing as needed for each segment and/or buying context you serve. Examine how inflation and uncertain economic conditions impact your traditional value drivers. Explore if there are new sources of value to be found due to the expected impact of inflation on your customer’s business model.

- Create and train your sales team to deliver compelling value stories that provide both a narrative context and demonstrate the real financial benefits your offering delivers.