In B2B markets, value drivers are the basic building blocks of any value model, value story, or value proposition. Yet crafting a good value driver is often the most difficult part of the process. But it doesn’t have to be so tough. It’s time to apply that age-old wisdom: when presented with a difficult task, break it down into more manageable pieces.

In B2B markets, value drivers are the basic building blocks of any value model, value story, or value proposition. Yet crafting a good value driver is often the most difficult part of the process. But it doesn’t have to be so tough. It’s time to apply that age-old wisdom: when presented with a difficult task, break it down into more manageable pieces.

It is important to start with a good concept of what a value driver really is. From there, we forge ahead to examine two basic methods for crafting simple value drivers for any product or service offering. If you are interested in learning how to create more complex value driver formulas, watch our short tool tip video to see how you can transform your value drivers with more complex formulas using LeveragePoint’s sub-formula capability.

What is a value driver?

One of the best definitions of a value driver comes from the book Value Merchants by James Anderson, Nirmalya Kumar, and James Narus. According to Anderson, et al, a value driver is:

a tool that enables a supplier to demonstrate and document points of difference and points of contention for its offering relative to the next-best alternative so that customer managers can easily grasp them, understand precisely how the supplier is assessing them, and be persuaded by the results. [Value drivers] provide a methodical way of convincingly demonstrating and documenting superior value in monetary terms.

A [value driver] expresses precisely in words and simple mathematical operators (e.g., +, ÷) how to assess the differences in functionality or performance between a supplier’s offering and the next-best alternative…and how to convert those differences into monetary terms. One is constructed for each point of difference (and point of contention)…Accompanying each [value driver] are the assumptions that the supplier is making about the value element and how its monetary value is assessed. (Anderson, et al, 52-53)

Note that Anderson, et al refer to value drivers as value word equations, where, “The value element, expressed as either cost savings or incremental profit, is on the left side of the equal sign, and the components defining the differences in functionality or performance and what they are worth are on the right side.” In other words, the left side of the equation is the value driver name, and the right side is the algorithm.

Method 1: Direct impact on a customer financial metric or KPI

Most simple value driver formulas have just two variables. The first is a customer variable, representing one of the customer’s financial metrics or key performance indicators (KPIs). The other is a product offering variable, representing a measurement of the supplier’s impact on the customer’s financial metric.

A value driver formula for this method would look like – [Customer Financial Metric or KPI] * [Impact Measurement]

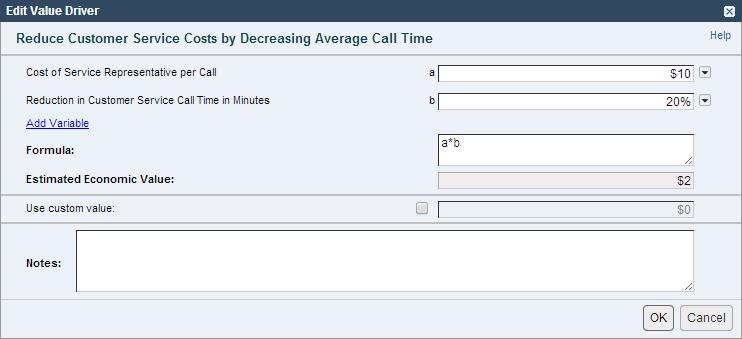

If you are using a software tool to help you calculate your value drivers, such as LeveragePoint, your formula would look like this:

Method 2: Impact on a non-financial customer metric or KPI

These value driver formulas break the customer variable into two distinct parts: a non-financial customer metric or KPI and a dollarization factor.

A value driver formula for this method would look like – [Non-financial Customer Metric or KPI] * [Impact Measurement] * [Dollarization]

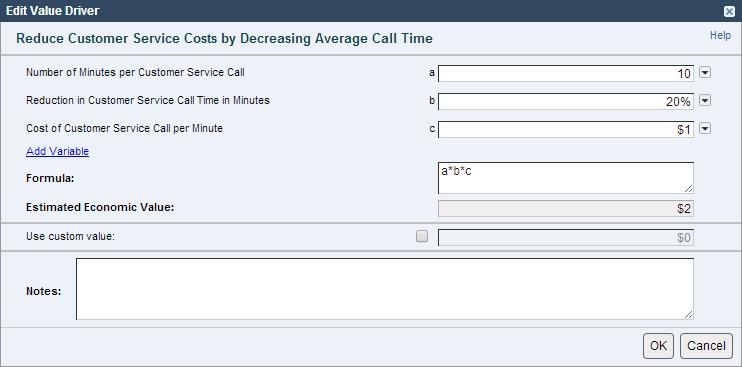

Notice that the two parts of the customer variable are split apart, with the impact measurement placed between them. The calculation using LeveragePoint would look like this:

This method helps show where the impact of the offering applies. In this example, the reduction is in the number of minutes spent per customer service call; not in the cost of the customer service call per minute.

Conversion Factors

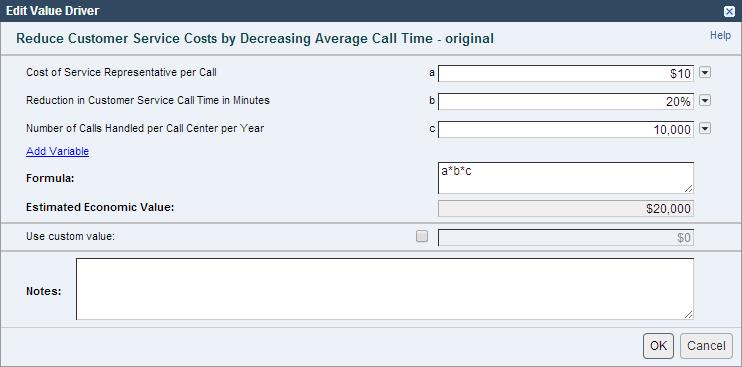

For either method, an additional variable is sometimes required to keep the unit of measure consistent with other value drivers in a given value model. This additional variable is called a conversion factor. For example, suppose you are studying the annual impact on a call center. The Method 1 example using LeveragePoint might become:

While many companies rely on spreadsheets to calculate and house value-data, cloud-based solutions (including LeveragePoint) can help to quickly and accurately capture, quantify and calculate customer value. If you maintain a value-data library in such a solution, you can easily organize and maintain value driver formulas for collaboration across a business unit or enterprise.